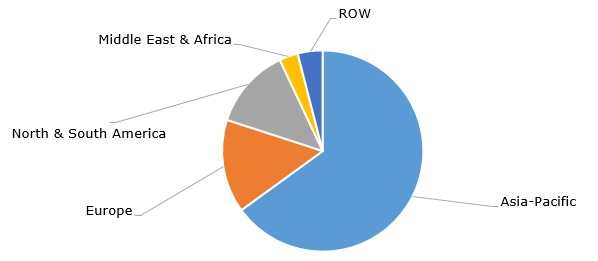

Polycarbonates (PC) form an important group of highly customizable thermoplastic polymers and engineering plastics used in various consumer applications, medicine, packaging, electrical devices, the automotive sector, electronics, construction, and optical media. Demand for polycarbonate resins is on the rise in all applications (with the largest growth rate in electrical devices and the automotive sector), apart from optical media, where demand for polycarbonates has significantly fallen over recent years. However, even in the consumption segment of optical media, polycarbonates may have good prospects due to the recent, both COVID and post-COVID, increases in the global sales of music CDs. The most popular polycarbonate tradenames include the following: Makrolon / Makrofol (Covestro), Lexan (SABIC), Panlite / Multilon (the latter as an alloy with ABS) (Teijin Chemicals), Iupilon / Novarex (the Mitsubishi Chemical Group) and Calibre (Trinseo). Asia-Pacific dominates polycarbonate consumption, while the region, especially China, is characterised by excess production overcapacity, including polycarbonate feedstock.

Polycarbonate resin: structure of the global consumption by region, 2022

Global demand for polycarbonates grew from about 4.5 mln tons in 2020 to over 5 mln tons in 2022, which shows strong growth despite the very challenging market conditions of these turbulent years. Such challenging market conditions continued to exist in H1 2023, driven by weak consumer demand, high inflation, and uncertainty. For instance, in Q1 2023, Trinseo confirmed that weaker demand, (except in the automotive market), led to lower sales volume and depressed margins for its polycarbonate products. In H1 2023 such sentiments persisted along the whole polycarbonate-related commodity chain, which starts from acetone/phenol via bisphenol-A to polycarbonate resins, their blends, and other end-products. This kept polycarbonate prices down practically on all markets.

All key polycarbonate manufacturers are eager to implement significant and innovative sustainability-focused efforts. For example, in 2024, SABIC plans to launch a polycarbonate plant in Cartagena (Spain), which will be the world’s first large-scale chemical plant to run on 100% renewable power. Likewise, the Mitsubishi Chemical Group plans to commercialise the world’s first polycarbonate resin recycling facility based on chemical recycling by depolymerization as opposed to traditional mechanical recycling of polycarbonates. LG Chem will apply carbon capture, usage, and storage technology and build an innovative carbon mitigation facility to produce polycarbonates and other materials. These facts confirm that corporate sustainability and climate adaptation activities become a commercial imperative for any business looking to be competitive in the long term.

Find a comprehensive analysis of the global polycarbonate market in the in-demand research report “Polycarbonate (PC): 2023 World Market Outlook and Forecast up to 2032”.