Bisphenol A (bisphenol-A, BPA) or 2,2-bis (4-hydroxyphenyl) propane is a phenol/acetone-based intermediate chemical that is mainly used to manufacture polycarbonate resins (65% of BPA use) and epoxy resins (30% of BPA use). Polycarbonate resins are applied in such sectors as automotive, healthcare, consumer goods, packaging, electrical devices, electronics, construction, leisure, and optical media. Epoxy resins find application in protective coatings, paints, adhesives, industrial tooling, pipes, floor coverings, and wood-based products. As such, these sectors largely define BPA consumption patterns.

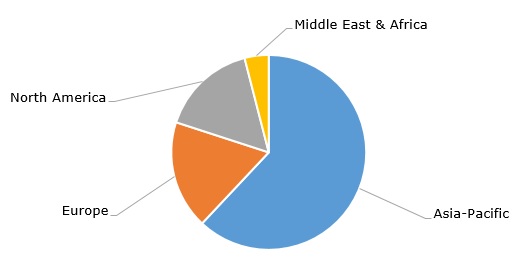

Exposure to high levels of Bisphenol A can be detrimental to human health and the environment as it is a proven endocrine-disrupting chemical with adverse genotoxic effects. This results in strict regulation of BPA usage. For example, one can mention the EU regulation as of 2018, which lowered the limit for BPA migration from food packaging into food to almost negligible amounts. In general, the use of Bisphenol A in the EU is significantly restricted, while some countries are considering its total ban. In 2021, global BPA production exceeded 8 million tons. Asia Pacific accounts for the largest share of BPA production capacity and acts as a major exporter of BPA.

Bisphenol A: structure of the global production capacity by region, 2022

The current behaviour of the BPA market is characterised by reduced global demand for the compound in the BPA-consuming sectors, which is reflected in lower capacity utilization rates and significant price cuts. As energy costs eased off in H1 2023, demand for BPA did not pick up due to high inflation rates and bearish sentiment on the global market. Meanwhile, BPA supply remains ample, which tightens competition. For example, in Q1 2023, Covestro, one of the world’s leading manufacturers of high-quality polymer materials and their components, including Bisphenol A, announced drops in sales (both in volume and value terms), as well as lower selling price levels and margins. Somewhat better, but only slightly, results were demonstrated by Westlake Corporation in its Performance and Essential Materials division, to which BPA production is affiliated (in 2022, Westlake Corporation acquired the epoxy resins business from Hexion).

Sustainability plays a pivotal role in the market for Bisphenol A and its derivatives. All key BPA producers set clear net zero targets and develop polymer circularity. For instance, in June 2023, Kumho P&B Chemicals (South Korea) announced that it has obtained ISCC PLUS certification for its five products, such as cumene, phenol, acetone, Bisphenol A, and epoxy resins. ISCC PLUS stands for a highly acclaimed international certification system that verifies the sustainability of the entire production process in accordance with the EU Renewable Energy Directive.

Find a detailed analysis of the global bisphenol A market in the insightful research study “Bisphenol A (BPA): 2023 World Market Outlook and Forecast up to 2032”.