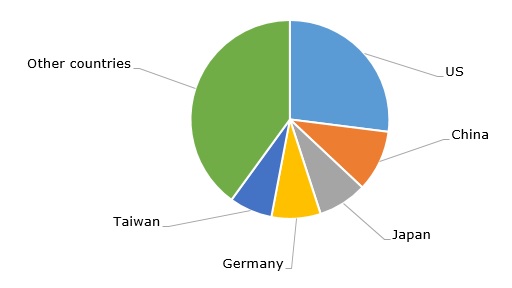

Cumene (also known as isopropylbenzene) is a simple alkyl aromatic hydrocarbon and an important chemical intermediate within a complex value chain. This chain includes fossil resources, refinery-grade propylene, benzene, phenol/acetone, methyl methacrylate, Bisphenol A, and a wide range of other derivatives and products (e.g. polycarbonate resins, epoxy resins, solvents, etc.). These products are used in the automotive, construction, electronics, healthcare, household appliances, sports equipment, and fibre industries. Global cumene production capacity is dominated by the US. In 2022, this country manufactured over 3 million tons of cumene.

Cumene: structure of the global production capacity by country, 2022

Cumene is produced by reacting benzene and propylene via the Friedel‐Crafts alkylation reaction. Like ethylene and mixed xylenes, both benzene and propylene are petrochemical building blocks with a growing gap between demand and excessive production capacity. This trend of exceeding demand by production capacity is now common across the whole chemical industry and might pose a threat to various chemical markets, especially in the current context of weakened demand, volatile energy prices, high inflation, and struggling macroeconomics. This adverse market environment was partially offset by the fact that in Q3 2023, some regional markets experienced certain declines in prices for cumene feedstock materials.

Despite this trend, companies may be guided by different considerations when they expand their production capacities. For example, INEOS Phenol’s decision to acquire Mitsui Phenols Singapore Ltd. was governed by a desire to enter the Asian market and strengthen its position in the cumene derivative segment, such as Bisphenol A. Apart from other assets to be purchased under this deal, Ineos Phenol will acquire 410k mty cumene production unit from Mitsui Phenols Singapore Ltd. (Ineos manufactures cumene at its facilities in Marl, Germany, and Pasadena, Texas, US). It is pertinent to mention that Singapore has been acting as a major cumene exporter (in 2020 its cumene export value exceeded 300 million US dollars). The first half of 2023 witnessed the increase of cumene derivatives exports to Europe from Asia as Asian producers were able to offer quite competitive prices.

Find a comprehensive analysis of the global cumene market in the in-demand research report “Cumene: 2023 World Market Outlook and Forecast up to 2032”.