Calcium chloride (CaCl2) is an inorganic salt and a multifunctional chemical product used in a wide range of applications and commodities, such as the oil and gas industry, water treatment, de-icing, dust control, metallurgy, cement, concrete and gypsum, agriculture, tires, electronics, refrigeration, food and beverages, to name only a few. It is evident that seasonal factors loom large in some of these applications (e.g., agriculture, de-icing, etc.), making the calcium chloride market vulnerable to the influence of climatic and weather events. The latter becomes particularly topical in the current climate change environment.

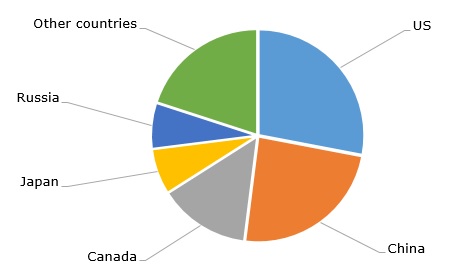

Serving different end applications, calcium chloride is manufactured in different grades and forms (both solid and liquid). In 2022 global calcium chloride production was about 4.58 million tonnes and is expected to grow by 3-4% annually. Of course, this excludes force majeure circumstances and macroeconomic upheavals. For instance, the COVID pandemic resulted in a calcium chloride production drop in 2020. The US remains a leading calcium chloride producer. China is the world’s largest calcium chloride exporter. In 2021 this country exported calcium chloride to the amount of USD211 million in value terms.

Calcium chloride: structure of the global production by country, 2022

Calcium chloride originates from natural feedstocks and industrial by-products. Calcium chloride can be obtained with the help of the following methods: (a) from natural brines, mostly associated with lakes (low purity calcium chloride might be a problem under this method); b) a process involving hydrochloric acid neutralization with limestone (this method can provide a high purity calcium chloride); (c) a by-product of the Solvay process of soda ash production; and (d) a byproduct of manufacturing magnesium oxide. In the contemporary market environment in which the realization of sustainability principles becomes a competitive business differential, sustainable production of calcium chloride is of key significance. Therefore, major calcium chloride-producing companies, like US-headquartered TETRA Technologies, Inc. (TTI) or OxyChem, manufacture calcium chloride using a wide array of sustainable technologies and approaches to minimise waste and reduce carbon footprint. This involves CO2 capturing, circular economy methods, and adherence to ecological certification.

Currently, TTI manufactures calcium chloride at its four US locations, as well as in Finland, Germany, and Sweden. It also operates an extensive calcium chloride supply network of terminals and warehouses in the US and Europe. TETRA Technologies reported strong margins in its industrial calcium chloride business during Q2 2023. As for OxyChem, in its forecasts for the market developments in 2023, OxyChem is rather cautious, marking such factors as the decline in demand for basic chemicals (to which calcium chloride belongs in OxyChem’s operational structure), the health of the global economy, rising inflation rates, high feedstock, and energy prices, supply chain interruptions (incl. semiconductor supplies) and labor constraints. OxyChem operates 700k mty calcium chloride capacity at Ludington (Michigan, US).

Find a detailed analysis of the global calcium chloride market in the in-demand research report “Calcium Chloride (CaCl2): 2023 World Market Outlook and Forecast up to 2032”.