P-xylene (para-xylene, paraxylene, PX) belongs to a group of petrochemical products known as aromatics (benzene, toluene, and xylenes, often abbreviated as BTX). Being an aromatic hydrocarbon, it is traditionally produced by catalytic reforming of petroleum naphtha via a series of subsequent separation processes. The role of para-xylene is vital because it is a key material utilized in the synthesis of terephthalic acid, dimethyl terephthalate (DMT), purified terephthalic acid (PTA), and polyesters, such as polyethylene terephthalate (PET). These chemicals are indispensable in packaging, textiles, apparel, home furnishings, adhesives, automotive components, and a wide range of other commodities.

There are various industrial methods of p-xylene production, such as, for example, the toluene methylation process, which involves toluene and methanol (e.g. Lummus Technology has been developing paraxylene-manufacturing technologies). For example, INEOS stated that it manufactures its PX via isomerization of the mixed xylene refinery stream. In 2021 this company acquired the aromatics business, including PX and PTA units, from BP. INEOS operates 1.6 million mty PX capacity located in Texas City (US) and Geel (Belgium). A promising industrial route is the use of renewable bio-based feedstocks. Therefore, Origin Materials, a US-headquartered material technology company, converts woody biomass into chloromethyl-furfural (CMF), oils, and hydrothermal carbon to use CMF as an intermediate for manufacturing PX, furandicarboxylic acid, and other products.

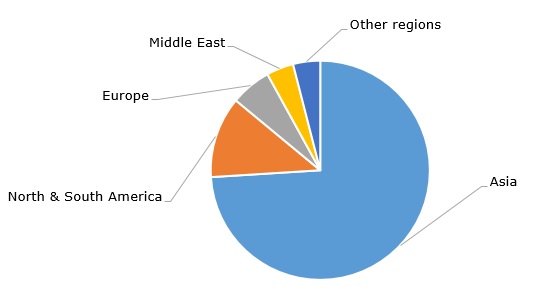

P-xylene: structure of the global production capacity by region

The current annual p-xylene production capacity will soon approach 80 million tonnes with Asia being the largest PX-producing region. Over the recent years, the region has been very active in expanding its p-xylene production capacity. To illustrate this point, one can mention new PX production capacities developed by Zhejiang Petrochemical (the Daishan Complex), Hengli Petrochemical (the Dalian Complex), Zhejiang Petroleum and Chemical Co. (a p-xylene project in Zhejiang province, China), Shenghong Petrochemical Group (a refining and petrochemical facility in Jiangsu province, China), or continuous program of aromatics capacity expansion realised by PetroChina. Such consistent, but sometimes aggressive, expansion of p-xylene production capacity may pose certain risks against the background of the current economic slowdown in China. It also limits the margins of PX producers.

The current situation on the p-xylene market in Europe is tinged with an easily traceable bearish mood. Demand in multiple PX-consuming sectors exhibits a downward trend or at least is sluggish. The macroeconomic situation in the region remains unstable, while the outlook for the rest of 2023 does not look optimistic. This is paralleled by a fair degree of volatility in energy and feedstock prices, as well as by high inflation pressure. The p-xylene prices dropped in H1 2023 as compared to their peak in May 2022, but not very significantly. The further trajectory of p-xylene prices will be predicated on the recovery of demand for PET resins and fibres, which seems unlikely in the near future.

Find a detailed analysis of the p-xylene market in the in-demand research study “P-xylene (PX): 2023 World Market Outlook and Forecast up to 2032”.