Ethylene dichloride (EDC; 1,2-dichloroethane) belongs to a family of chlorohydrocarbons. It is a large-tonnage chemical involved in the synthesis of other compounds within the chlor-vinyls value chain of products. This complex value chain comprises the following: ethylene, chlorine/caustic soda, EDC itself, vinyl chloride monomer (VCM), polyvinyl chloride (PVC; a major EDC-consuming sector with construction acting as a key EDC outlet), and a wide assortment of downstream products. Apart from construction, ethylene dichloride is also used in the production of solvents, oil/gas exploration, healthcare, the automotive industry, packaging, and other sectors. Ethylene dichloride is considered toxic and possibly carcinogenic, which poses certain barriers to its market development. Ethylene dichloride is manufactured via direct ethylene chlorination or ethylene oxychlorination (or a combination of both).

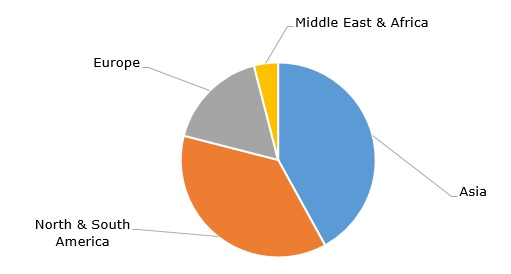

Ethylene dichloride: structure of the global production by region, 2023

The global EDC production capacity is around 50 million mty, while Asia and North America are the largest EDC-producing regions. The EDC market is tightly coupled with upstream chlorine/caustic soda production, as well as with downstream PVC and construction sectors. For instance, EDC production in the US plunged by over 3 million mt as compared to 2005 following the financial crisis of 2007-2009, which exerted detrimental pressure on the US housing and construction markets. Likewise, in the current unstable macroeconomic environment, driven by the slower global macroeconomic activity of Q2 and Q3 2023, weak demand on the construction and PVC markets adversely affected EDC consumption, which was recently confirmed by the chlor-alkali-vinyl divisions of such corporations as Dow, Olin, and Oxy. This led to a decrease in EDC prices in the US. In China, downward pressure on EDC prices was evident too during H1 2023.

To this extent, EDC production is often integrated with PVC manufacturing. To illustrate this point, one can mention Westlake Chemical Corporation with its extensive vertically integrated chlor-vinyls manufacturing facilities worldwide. The company has the capacity to produce over 5 billion pounds per year of PVC in the US alone using its own raw materials. In the US, Westlake Chemical manufactures EDC at its 1.55 million mty facility in Lake Charles, Louisiana. In pursuit of the sustainability targets, Westlake Vinnolit (Westlake acquired Vinnolit Holdings GmbH in 2014) manufactures bio-attributed PVC under the GreenVin tradename. Such sustainable initiatives may provide tangible benefits for EDC-manufacturing companies.

Find a comprehensive analysis of the ethylene dichloride market in the in-demand research report “Ethylene Dichloride (EDC): 2023 World Market Outlook and Forecast up to 2032”.