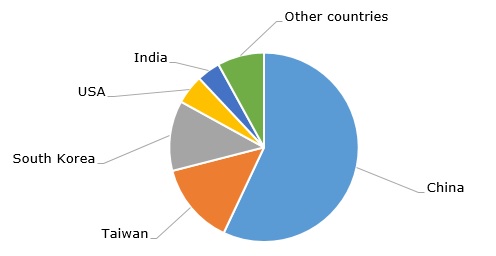

Dioctyl phthalate (DOP or di-n-octyl phthalate, DnOP) belongs to a multi-functional class of high-tonnage chemical compounds known as phthalates, which are the esters of phthalic acid. Phthalates are added to various polymer materials (e.g. polyvinyl chloride or PVC) as plasticizers to modify their flexibility, durability, viscosity, processability, and other characteristics (global demand for plasticizers of different types is currently about 10 mln tons per year). This makes DOP a powerful tool of polymer customization, as well as significantly expands its applicability in such business sectors as automotive, electronics, construction, packaging, healthcare sports, and clothing. Like other phthalates, it can be also used as a raw material for various industrial applications. The pathway for dioctyl phthalate manufacturing includes o-xylene, phthalic anhydride (PA), and 2-ethylhexanol, while bio-derived plasticizers are also currently being developed. China accounts for over 50% of the global DOP market capacity.

Dioctyl phthalate: structure of the global production capacity by country, 2023

The significant limitation of phthalates application is their proven toxicity and ability to cause many adverse health effects. Therefore, their application in various consumer markets, such as cosmetics, plastic food contact materials, toys, childcare items, or medical devices, is strictly regulated. As a result, there is an ongoing practice of replacing traditional phthalic plasticizers with more environmentally friendly ones, like dioctyl terephthalate, also known as di(2-ethylhexyl) terephthalate or DEHT. For example, Grupa Azoty (Poland) manufactures a general-purpose bis (2-ethylhexyl) terephthalate non-phthalate plasticizer under the Oxoviflex tradename. Likewise, UPC Technology Corporation (UPC) manufactures non-phthalate UniHydro plasticizers (UPC’s capacity for this plasticizer is 240k mty). If the replacement of phthalate plasticizers is achieved, companies like Apple may announce that their products are now phthalates-free.

The dioctyl phthalate market in Q4 2023 remains subdued mainly due to weak demand in practically all sectors consuming plastics engineering plastics. Naturally, this affects the consumption of DOP and other plasticizers. The situation on the dioctyl phthalate market is exacerbated by end-of-year seasonality and destocking activities, paralleled by previously accumulated high stock levels. In addition, cheaper imports are currently available. Other unfavourable macroeconomic factors weigh heavily on the market, like high inflation rates, though despite the latter, general consumer sentiments look positive. The above-mentioned Grupa Azoty reported a significant drop in financial performance across all sectors, including plastics. The company also blamed weak demand and an unhealthy macroeconomic environment. The mild winter has not so far led to a significant boost in energy costs, but their current levels, coupled with energy price volatility, continue to be a significant barrier, especially for European chemical manufacturers.

Find a detailed analysis of the dioctyl phthalate market in the in-demand research report “Dioctyl Phthalate (DOP): 2023 World Market Outlook and Forecast up to 2032”.