Liquid crystal polymers (LCP) are high molecular weight materials and thermotropic (melt-orienting) thermoplastics with a capacity to enter a physical state (phase) between an ordered solid body and a disordered liquid. In other words, they combine the anisotropic physical properties of crystals with the isotropic characteristics of liquids. Liquid crystal polymers demonstrate useful properties, such as high flowability without flash propensity, flame retardance, exceptional chemical inertness, high thermal resistance, increased tensile strength, dimensional stability, and weatherability. Owing to their low melt viscosity, almost zero shrinkage in the flow, and short solidification time, liquid crystal polymers form thinner parts and retain the same advanced performance under lower use of the material. This is critical in order to partially offset the high costs of LCP-based products.

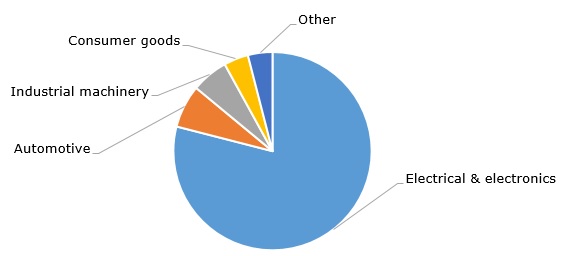

Liquid crystal polymers were thoroughly investigated in the early 20th century but were commercialized only in the 1960s. They are multi-functional with key application areas in electrical insulation systems, high-performance fibres, composite materials, optical storage elements, holography, actuators, microelectromechanical systems, and medical devices. There is a growing interest in identifying novel areas of their application. Global demand for liquid crystal polymers exceeds 80 thousand tonnes per year, while its market is worth USD 1.6 billion. The electrical and electronic sector, especially the production of components for OLED displays, PCs, and smartphones, dominates LCP consumption.

Liquid crystal polymers: structure of the global consumption by sector, 2023

The LCP market is driven by advances in digital technologies, the rollout of 5G networks, the manifestation of sustainable approaches, and the proliferation of electric vehicles (EVs). In general, the whole sector of advanced polymers exists at the intersection of business, social, and natural ecosystems, when changes in consumer buying trends are shaped by environmental concerns and are supported by service-rich technological innovations. For example, Solvay manufactures LCPs under the Xydar trademark, which is a vivid illustration of how high-performance LCPs can be employed in EVs for battery insulation purposes, apart from its use in other car components. Liquid crystal polymers particularly suit the new generation of EVs, which have to meet the strict environmental and exploitation requirements. Unsurprisingly, Sumitomo Chemical plans to launch an additional LCP-manufacturing plant in Ehime (Japan) in 2023 to capture a share in battery motor applications (Sumitomo Chemical’s LCP trademark is entitled SUMIKASUPER).

However, despite these factors driving the LCP market, Sumitomo Chemical considers 2023 to be a difficult year for the advanced polymers business. The current global economic slowdown has taken its toll, and Sumitomo Chemical recorded decreased revenues in all sectors, including its polymers business. In a similar vein, in Q3 2023 Celanese, which manufactures LCPs under Zenite and Vectra trademarks, reported worse financial results, as compared to the previous quarter, in its advanced materials sector due to weaker demand for these products.

Find a comprehensive analysis of the liquid crystal polymers market in the insightful research study “Liquid Crystal Polymers (LCP) 2023 Global Market Review and Forecast to 2032”.