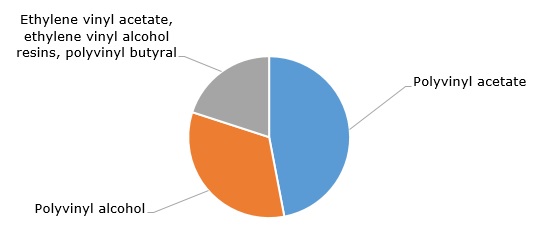

Polyvinyl acetate (PVA) is an important chemical derivative featuring all homopolymers and copolymers with the vinyl acetate content of at least 50%. PVA is embedded in an extended network of upstream and downstream chemical products. This network comprises such compounds as vinyl acetate monomer (VAM), polyvinyl alcohol (PVOH), ethylene vinyl acetate (EVA), ethylene vinyl alcohol (EVOH), and polyvinyl butyral (PVB). In turn, VAM, as a precursor of polyvinyl acetate, uses such key raw materials as ethylene and acetic acid. Acetic acid can be produced from bio-based feedstock (e.g. vinyl acetate ECO-B option offered by Celanese Corp.). However, despite the renewable nature of bio-based feedstock, the issues of increased land use and biodiversity reduction due to bio-resource exploitation may raise certain concerns. Polyvinyl acetate acts as a major outlet for VAM, while PVA itself, due to its excellent adhesion properties and a capacity to be applied for different substrates, is mainly used in the production of adhesives, textiles, fibres, industrial coatings, films, nonwoven materials, and paints.

Vinyl acetate: structure of the global consumption by sector

The current behaviour of the polyvinyl acetate market follows the general trends of the global petrochemical market. These trends are nowadays shaped by the global economic slowdown, decreased demand across nearly all-consuming sectors, weakened pricing conditions in relation to key acetyl products, continuing high energy prices, and reduced profit margins. For example, US-headquartered Celanese had to idle its VAM production in Frankfurt, Germany during Q3 2023 in order to reduce inventories and combat unfavourable pricing. The company’s acetyl chain has been also adversely affected by acetic acid supply disruptions from China. Unsurprisingly, in Q3 2023 Celanese’s acetyl chain business segment performed worse than in Q2 2023 or during the same period a year earlier. WACKER, a Germany-headquartered company and a key producer of polyvinyl acetate, reported an even stronger decline in its polymer sales in Q3 2023. The company representatives name the same above-mentioned reasons responsible for this decline. The forecasts of the quick reinvigoration of the PVA market look unrealistic.

Find a detailed analysis of the polyvinyl acetate market in the in-demand research study “Polyvinyl Acetate (PVA): 2023 World Market Outlook and Forecast up to 2032”.