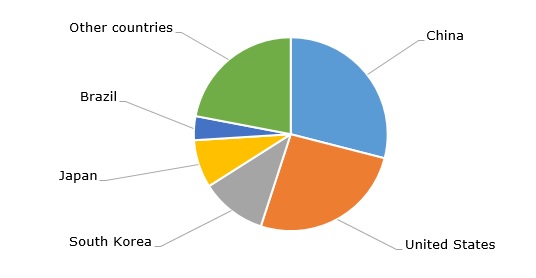

Polybutadiene (PBR) is an amorphous sticky material and a synthetic rubber acting as a viable alternative to natural rubber. The popularity of synthetic rubber has gained momentum since WWII. The production of tires and re-tread tires accounts for the bulk of polybutadiene rubber consumption, while tire treads and sidewalls consume over 70% of polybutadiene used in the whole tire product. In general, polybutadiene is applied in a wide range of technical and consumer rubber products, especially where requirements for temperature and chemical resistance are not very strict. Polybutadiene rubber is noted for its excellent resistance to aging and abrasion, as well as for its high resilience and low-temperature flexibility. The global production capacity of polybutadiene rubber exceeds 4 million tonnes per year. China with a production volume of about 730k mty of PBR is currently the world’s largest PBR producer, followed by the US with 550k mty PBR output.

Polybutadiene rubber: structure of the global production by country, 2023

The tire industry is strongly influenced by environmental and safety regulations, carbon footprint targets, evolving standards in fuel consumption, and the overall trend to use products with better performance. For example, new tire labeling rules in the EU countries, which became effective in May 2021, stipulate the performance of tires with respect to issues relating to fuel efficiency, safety, and noise. Such regulations drive the need for neodymium polybutadiene rubber (Nd-BR), which is used in the so-called green tires known for their high resistance to abrasion, fatigue, wear, groove cracking, and rolling. Just as an illustration of this prospective sector, Synthos Group (Poland) and Kumho Tire, a leading South Korean tire manufacturer, plan to realise a joint research and development project to produce neodymium polybutadiene rubber using bio-butadiene. Synthos intends to build a plant with a production capacity of 40k mty of bio-butadiene. Kumho Tire has already produced tires made from 55% sustainable raw materials and is currently developing tires made from 80% sustainable raw materials. Kumho Petrochemical is also a manufacturer of ultra high-cis polybutadiene rubber, made using neodymium catalysts.

However, several major challenges have recently confronted the synthetic rubber market. Among such challenges, one can mention severe supply disruptions caused by the COVID-19 pandemic, the global semiconductor chip shortage, and the current economic slowdown. All these affected the car and tire industries. Unsurprisingly, several key polybutadiene producers struggled in such a turbulent market environment. For instance, US-headquartered Trinseo (formerly Styron) with its 30k mty polybutadiene facility in Schkopau (Germany) had to idle it in 2020 and then sold it to Synthos Group a year later after experiencing significant financial losses. Synthos brought this facility back on stream in 2023.

Find a comprehensive analysis of the global polybutadiene rubber market in the in-demand research study “Polybutadiene Rubber (BR): 2023 World Market Outlook and Forecast up to 2032”.