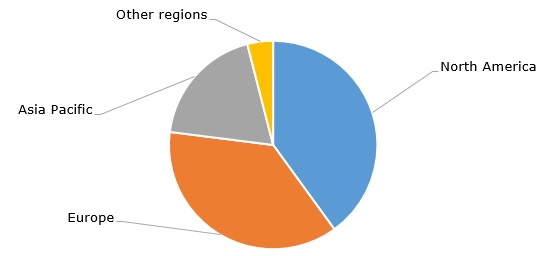

Hydrogen cyanide (HCN, also known as prussic acid) is a volatile liquid or gaseous organic compound and an important chemical intermediate used to manufacture such vital products as adiponitrile, hexamethylenediamine, methyl methacrylate, sodium cyanide, acetone cyanohydrin, methionine, cyanuric chloride and chelating agents (hydrogen cyanide is directly used as a fumigant). These products are in turn employed in a wide range of industrial and consumer applications, such as extraction and electroplating of precious metals, production of nylon 6,6 fibres, plastics, coatings, adhesives, fire retardants, cosmetics, pharmaceuticals, and food products. Therefore, an intermediate status of hydrogen cyanide and its embeddedness in diverse commodity value chains makes the hydrogen cyanide market highly susceptible to behaviours of various downstream and upstream markets. The current production of hydrogen cyanide exceeds 3 million tonnes per year. North America and Europe dominate global demand for hydrogen cyanide, while this demand is expected to increase by 2-3% per year in the near future.

Hydrogen cyanide: structure of the global demand by region, 2023

Commercial production of hydrogen cyanide involves the reaction of ammonia, methane, and air over a platinum catalyst, while it is usually manufactured as a by-product in manufacturing acrylonitrile or other chemicals. With a history of usage as a chemical warfare agent since World War I, though without any notable military success due to its extreme volatility in a gaseous form, hydrogen cyanide is known for its high toxicity and detrimental effects that prevent the body’s ability to use oxygen. The notorious reputation of the chemical was also earned during its application as Ziklon B gas used by the Nazi regime during World War II.

Due to the fact that a number of compounds produce hydrogen cyanide when burned (it is also present in cigarette smoke), extra care should be given to combustion gases leading to hydrogen cyanide inhalation as this may contribute to mortality. This toxicity of hydrogen cyanide deters international trade with hydrogen cyanide and raises the significance of measures related to hydrogen cyanide handling, exposure, control, and management. This is also a reason why hydrogen cyanide manufacturing is preferable to establish closer to consumption locations. Of course, most hydrogen cyanide is used directly at the production site. For example, US-headquartered Cyanco, the global leader in mineral extraction chemicals, manufactures sodium cyanide at its facility in the Chocolate Bayou industrial park (near Alvin, Texas) from hydrogen cyanide, supplied by Ascend Performance Materials and manufactured exactly in the same location.

The majority of hydrogen cyanide producers, like Ascend Performance Materials or Draslovka, feature diversified product portfolios applicable to multiple markets. As a result, such diversification assists these producers in mitigating the harsh consequences of the current turbulent macroeconomic environment, which is characterized by unprecedented increases in raw material and energy prices and rising inflation across all operational domains. However, some factors may invigorate the hydrogen cyanide market in the future. For example, the rise in gold and silver prices in 2024-2025, which is strongly predicted, may stimulate hydrogen cyanide consumption in mining applications.

Find a detailed analysis of the hydrogen cyanide market in the in-demand research report “Hydrogen Cyanide (HCN): 2024 World Market Outlook and Forecast up to 2033”.