Vinyl acetate monomer (VAM) is an important chemical intermediate indispensable in the production of an extensive range of consumer and industrial commodities. It is involved in the complex value chains of various feedstock materials, intermediates, derivatives, and end-products. Polyvinyl acetate (PVA) production is the largest outlet of vinyl acetate monomer. PVA demonstrates excellent adhesion properties with different substrates including paper, wood, plastic films, and metals, so it is widely used in adhesives, coatings, and paints. The second largest VAM-consuming sector is polyvinyl alcohol (PVOH) manufactured on a PVA basis. The main uses of PVOH include textiles, adhesives, packaging films, thickeners, and photo-sensitive coatings. Apart from that, PVOH finds application in manufacturing polyvinyl butyral (PVB) resin, mainly used in laminated glass for vehicles and buildings, as well as in coatings and inks. Other chemicals produced from vinyl acetate monomer are as follows: ethylene vinyl acetate (used for wire and cable insulation), vinyl acetate ethylene (cement additives, paints, and adhesives), ethylene vinyl alcohol (barrier resin in food packaging, plastic bottles, gasoline tanks, and in engineering polymers), vinyl chloride-vinyl acetate copolymers and polyvinyl formal.

There are different industrial routes to manufacture vinyl acetate monomer. VAM is traditionally manufactured via a vapour phase reaction of acetic acid with ethylene and oxygen with the help of palladium catalysts; VAM is further recovered by condensation and scrubbing and purified by distillation. VAM production technologies are driven by the need to minimise carbon footprint, enhance energy efficiency and reduce consumption of raw materials. Vinyl acetate monomer can be manufactured from biomass-based acetic acid (e.g., the VINNAPAS product line offered by WACKER Group or the ECO-B product portfolio by Celanese).

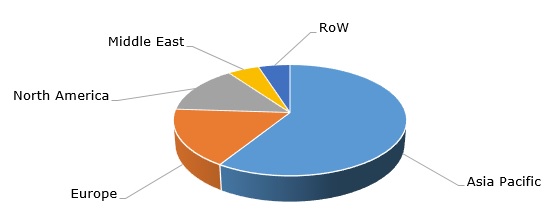

VAM prices are largely feedstock-driven and mirror the dynamics of upstream ethylene costs. The ethylene market is currently dominated by such trends as excessive production capacity availability, weak demand, low profitability, and falling capacity utilization rates. Global demand for vinyl acetate monomer exceeds 6 million tons per year and is expected to reach 8 million tons per year in the next five years. Global VAM consumption is expected to track average GDP growth as VAM is widely used in industrial applications. This growth is likely to account for 2-3% per year and will be concentrated in Asia, primarily in China. China is also a main VAM-importing country, followed by Belgium, Germany, India and Turkey. In general, Asia Pacific is actively expanding VAM production capacity. For example, LOTTE INEOS Chemical will build a new vinyl acetate monomer plant in Ulsan, South Korea. The plant will have a production capacity of 250,000 tons per year and will be launched in 2025.

Vinyl acetate monomer: structure of the global consumption by region, 2023

However, the current global economic slowdown, especially in Europe, coupled with reduced demand for chemicals and soaring energy prices, will dampen the VAM market growth in the near future. The US VAM market behaves better, despite some recent outages at VAM-producing facilities. In 2022, VAM production in the US exceeded 1.7 million tons per year.

To illustrate the adverse impact of the difficult market environment on the VAM market behaviour in 2023, one can use the example of WACKER and its polymers division, which also manufactures VAM. This division reported a significant decrease in sales as compared to 2022, which was mainly caused by the lower selling prices driven by a challenging economic climate. WACKER produces over 150,000 tons per year of VAM at its Burghausen site (Germany), and VAM remains the key raw material for almost all of the products sold by WACKER POLYMERS.

Find a detailed analysis of the vinyl acetate market in the insightful research report “Vinyl Acetate (VAM): 2024 World Market Outlook and Forecast up to 2033”.