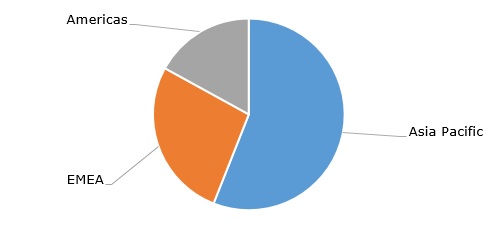

Nitrile rubber (nitrile butadiene rubber or NBR) forms a broad group of synthetic rubber copolymers of acrylonitrile and butadiene. Patented by the chemists Erich Konrad and Eduard Tschunkur in 1934, nitrile rubber is produced by performing emulsion polymerization using butadiene and acrylonitrile. The well-known NBR grades include Perbunan, Krynac, Baymod and Therban (all by ARLANXEO), Nipol and Zetpol (both ZEON), Europrene (Versalis/Eni), and KNB (Kumho Petrochemical). Asia Pacific is a leading NBR-consuming region.

Nitrile rubber: structure of the global consumption by region, 2023

Sustainability-driven trends are currently at the forefront of producing NBR and other synthetic rubbers. Therefore, LG Chem has converted the operation of its NBR-manufacturing plant located in Yeosu, South Korea to become carbon neutral by using only renewable energy. The production of synthetic rubbers from renewable bio-based feedstock is another major sustainability-focused trend. A joint project in this direction has been recently initiated by Idemitsu Kosan, KUMHO Petrochemical, and Sumitomo Corporation.

The experimentation with NBR composition and blending it with other materials open up significant opportunities for creating customizable polymeric products used in a wide range of applications, including specialized and innovative ones. The most common nitrile rubber applications involve automotive, industrial, consumer, aerospace, medical, oil exploration and many other areas. Nitrile rubbers are known for their resistance to oil, fuels, weak acids, caustics, nonpolar solvents, and other chemicals over a wide temperature range.

Traditionally, NBR producers operate with large portfolios of rubber products and could easily prioritize or vice versa curtail the production of a specific rubber product subject to concrete business conditions and market requirements. These conditions may vary. For example, the COVID-19 pandemic outbreak has given a substantial boost to the NBR medical glove market. Together with gloves made from natural rubber, NBR gloves are among the most popular and cheap. When specially treated, they are also highly effective in protecting against pathogens. During the COVID-19 pandemic, increased demand and skyrocketed prices for NBR gloves, paralleled by their shortage in many countries, drew large investments into the NBR glove market. The global NBR glove market is currently worth USD 10 bn., while Malaysia-headquartered Hartalega is a leading manufacturer of NBR gloves. However, the current demand for NBR gloves remains depressed. To illustrate the point, above-mentioned Hartalega now operates at 40-50% of its capacity utilization rate. Demand for this particular product is likely to pick up in H2 2024. As alluded to before, the nitrile rubber market is characterized by a significant degree of flexibility concerning employed capacity utilization rates, which are quickly adaptable to specific market conditions. Unsurprisingly, in late 2023, ARLANXEO announced about debottlenecking of its hydrogenated nitrile butadiene rubber plants in Orange, the USA, and Leverkusen, Germany. Demand for this type of NBR is currently on the rise.

Find a detailed analysis of the nitrile rubber market in the in-demand research report “Nitrile Rubber (NBR): 2024 World Market Outlook and Forecast up to 2033”.