Ethylene vinyl acetate (EVA) comprises a family of copolymers of ethylene and vinyl acetate. Ethylene vinyl acetates are highly customizable, for example, through varying the percentage rate of vinyl acetate in the copolymer. This augments the versatility of EVA applications by developing large portfolios of EVA-based products. For example, ethylene vinyl acetate copolymer resins manufactured and marketed by Dow under the ELVAX tradename represent the whole series of EVA grades for various applications. Likewise, Dow-Mitsui Polychemicals produces portfolios of ethylene vinyl acetate copolymers under the EVAFLEX tradename or LyondellBasell follows suit with its Micro/Petro/Ultrathene family of EVA copolymers applicable in a range of specialized areas.

Main areas of EVA usage include foaming and packaging, including for agricultural films, base components used in hot melt adhesives, sanitary items, garden hoses, pipes, coatings, dispersions, elastomers, films for solar cells in photovoltaic industry, electric wires, automobile parts, to name only a few. Ethylene vinyl acetate excels in such parameters as processability (including via extrusion, lamination, injection, and blow moulding), low-temperature toughness, stress-crack resistance, hot-melt adhesive waterproof capacity, resistance to ultraviolet radiation, and mechanical properties. EVA manufacturers use either autoclave or tubular technologies, which imply that the polymerization reaction occurs either in tubular or autoclave reactors respectively.

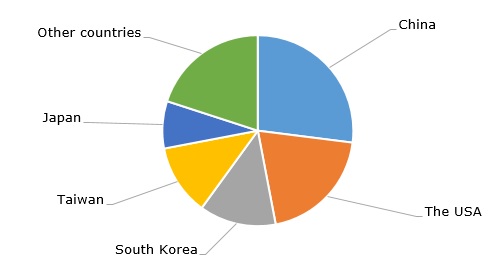

Ethylene vinyl acetate: structure of the global production capacity by country, 2023

China features the world’s largest EVA production capacities, operated by such companies as Sinopec, BASF-YPC (a JV between SINOPEC Yangzi Petrochemical Company Limited and BASF Group), Jiangsu Sailboat Petrochemicals (a wholly-owned subsidiary company of Shenghong Holding Group) and Dairen Chemical Corp. BASF-YPC plans to expand its current EVA production capacity by building a new 300k mty EVA unit in Nanjing. This EVA capacity expansion in China occurs in a turbulent macroeconomic environment, both globally and domestically. Despite this, the prospects of the EVA market in China look rather positive, driven by healthy demand from multiple sectors. In 2023, EVA prices in China varied significantly and were driven by a range of traditional factors, including demand and supply fluctuations, import availability, seasonality, and inventory build-up dynamics. In early Q1 2024, the Chinese EVA market is somewhat subdued by reduced margins, decreased capacity utilization rates, and seasonal factors. However, according to LyondellBasell’s CEO Peter Vanacker, the recovery of the macroeconomic situation in China is ongoing in 2024, but it will occur at a slow pace. Europe will likely be a challenging place due to high energy prices and depressed consumer sentiment. The USA will remain in a privileged position due to the lower costs of its feedstock materials. Sector-wise, plastic recycling, circular economy, and sustainability in general will continue to be the biggest challenges and opportunities in 2024. So, all major EVA producers will be implementing various sustainability initiatives in the coming years.

Find a comprehensive analysis of the ethylene vinyl acetate (EVA) market in the in-demand research report “Ethylene Vinyl Acetate (EVA): 2024 World Market Outlook and Forecast up to 2033”.