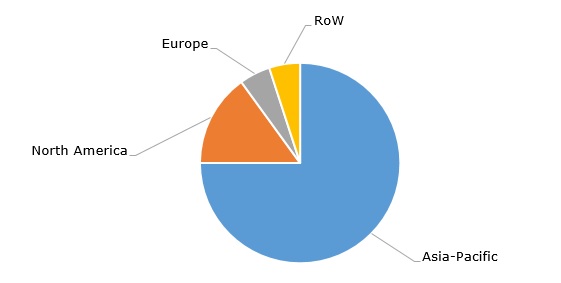

Polybutylene terephthalate (PBT) is a high-performance engineering polyester within a broader category of polycondensates. Being one of the most important polyesters, PBT resin is used primarily in the production of high-quality construction materials, especially for manufacturing cars (the largest end-sector for PBT), electronics, electrical devices, and household items. PBT is manufactured via the reaction of terephthalic acid with 1.4-butandiol (BDO) or by transesterification of terephthalic acid dimethyl ester (also known as dimethyl terephthalate) with the respective diol. Asia-Pacific accounts for a major share of polybutylene terephthalate production capacity in the world.

Polybutylene terephthalate: structure of the production capacity by region, 2023

PBT can be manufactured from renewable materials. Bio-based copolymers of PBT can be produced from bicyclic monomers derived from D-glucose. Apart from using renewable feedstock, main PBT producers are keen to implement sustainable principles into their operational activities by fully embracing a circular economy and by reducing their carbon footprint. Therefore, a few years ago, US-based Ascend Performance Materials acquired Poliblend (Italy), a company engaged in employing recycled polymers, such as nylon 6,6, polybutylene terephthalate, and polyoxymethylene. Likewise, Toray depolymerizes waste PBT from manufacturing processes and repolymerizes it again for further application. In general, to facilitate the transition to more sustainable production and to improve access to recycled polymers, polymer manufacturers eagerly acquire companies that specialise in manufacturing recycled polymers and in the compounding of recyclates.

Key PBT brand names and product lines are represented by multiple, often customizable, grades, which are gathered in extensive portfolios of products. The following brand names from selected manufacturers are particularly known: Arnite and Pocan (Envalior, which merges the efforts of DSM Engineering Materials, global private equity firm Advent International and specialty chemicals company LANXESS), Crastin (Celanese), Duranex (Polyplastics and Daicel Group), Enduran and VALOX (SABIC), Toraycon (Toray), Ultradur (BASF) and Vestodur (Evonik). Apart from manufacturing, some companies, like Distrupol, may act as major distributors of thermoplastic polymers and elastomers.

The behaviour of the polybutylene terephthalate market is currently characterized by challenging macroeconomic conditions and concerns of persistent demand decline across various regions, specifically Europe and China. The performance of various companies during the first half of Q1 2024 is a clear indication of the above trends. The demand environment in 2024 is likely to mirror that of the previous year. Some companies will be mulling over a decision to cease polymer production at certain locations in Europe due to high energy and raw materials costs.

Find a detailed analysis of the global polybutylene terephthalate (PBT) market in the in-demand research report “Polybutylene Terephthalate (PBT) 2024 Global Market Review and Forecast to 2033”.