Polyvinyl alcohol (PVOH) is an acetylene-based polymer used in adhesives, films, packaging, paper, textile fibres, ceramics, agriculture, the oil industry, construction, and other applications and industries. PVOH is the product of the hydrolysis of polyvinyl acetate. The latter is manufactured via the process of polymerization of vinyl acetate monomer (VAM), which is in turn produced by reacting acetic acid, oxygen, and ethylene. Therefore, polyvinyl alcohol is embedded in complex commodity and value chains, which makes the behaviour of the PVOH market susceptible to the dynamics of the markets for various feedstock materials, chemical building blocks, and consuming sectors. China is the world’s largest manufacturer of polyvinyl alcohol.

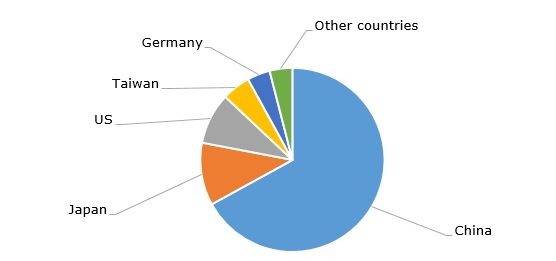

Polyvinyl alcohol: structure of the global production by country, 2023

Key polyvinyl alcohol producers (e.g. Sekisui Chemical) witnessed unfavourable PVOH market environment in late 2023 and early 2024, especially in Europe and Japan. However, Sekisui Chemical managed to balance operating profits and losses, thus achieving a robust financial performance in 2023. Sekisui Chemical manufactures polyvinyl alcohol (under the SELVOL tradename), which is used to make a range of polyvinyl acetal resins (the company operates the largest PVOH capacity in the USA). Likewise, Japan-headquartered Kuraray encountered adverse market conditions in Q4 2023. As of November 2023, the company announced its decision to upwardly revise polyvinyl alcohol prices for all regional markets due to increased feedstock costs and a stressed macroeconomic environment. Kuraray is the world’s largest producer of polyvinyl alcohol, while its POVAL trademark celebrated its 65th anniversary in 2023. In 2023, Japan produced about 187 thousand tonnes of polyvinyl alcohol, though in the pre-COVID years, the country’s PVOH production volume exceeded 230 thousand tonnes per year (e.g. in 2013 and 2017).

Sustainability-focused initiatives are critical for the polyvinyl alcohol sector. Different elements lie at the cornerstone of these initiatives. Firstly, key polyvinyl alcohol manufacturers are actively engaged in the realization of their sustainability plans. For instance, Sekisui Chemical, which is named one of the most sustainable corporations in the world, has developed a detailed and systemic sustainability plan. Secondly, sustainability-focused initiatives of polyvinyl alcohol manufacturers benefit from adopting a circular economics perspective. Thirdly, PVOH producers prioritise the use of Life Cycle Assessment to understand the environmental impacts of their products. For example, Kuraray performed an LCA analysis to show that the current environmental impact of its PVOH (marketed under the POVAL tradename) is equal to 2.47 kg CO2e per 1 kg of PVOH. Once measured and monitored, this environmental impact can be further reduced by applying sustainable measures across the cradle-to-grave value chain. Fourthly, the proliferation of various potential approaches to CO2 application via Carbon Capture and Utilisation (CCU) technologies is another prospective area of sustainability efforts of PVOH manufacturers.

Find a detailed analysis of the polyvinyl alcohol (PVOH) market in the in-demand research report “Polyvinyl Alcohol (PVOH): 2024 World Market Outlook and Forecast up to 2033”.