Polyethylenes (PEs) are generally referred to as homopolymers of ethylene, as well as ethylene copolymers with some olefins. Ethylene can be obtained by cracking ethane or naphtha, which are in turn derived from natural gas and oil, respectively. Fossil fuel-derived feedstocks can be replaced by bio-based materials. For instance, INEOS Group makes bio-based polyethylene at its plant in Lillo, Belgium, with the help of wood processing residues accumulated by the paper industry. INEOS used this polyethylene to produce a gas pipeline for a French gas utility network operator. Bio-based polyethylene features a lower carbon footprint as compared to traditional PE.

Globally, polyethylene accounts for the largest production volume among other plastic materials with a total production capacity of 67 million tonnes per year and consumption of 54 million tonnes per year (the gap between capacity and consumption is likely to increase in the near future, especially after the realization of planned PE capacity expansions). Asia Pacific is a leading producer of polyethylene with roughly half of the global PE production, while the remaining PE production shares are nearly equally spread between North America, the Middle East, and Europe. Popular PE brands are as follows: Dowlex (Dow), Eltex (Ineos), Eraclene (Eni/Versalis), Lupolen (LyondellBasell), Marlex (Chevron Phillips), Formolene (Formosa Plastics) and Paxon (ExxonMobil).

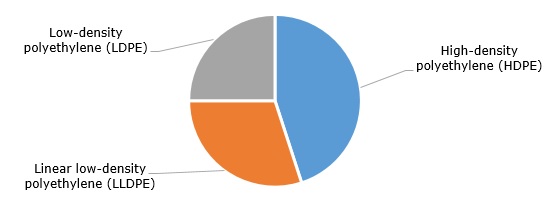

Polyethylene is ubiquitous, low-cost, functional, and highly customizable; it also demonstrates excellent capacity for insulation, chemical stability, processability (via blow moulding, extrusion, and injection moulding), transparency, toughness, and other valuable properties. Key polyethylene types include low-density polyethylene (LDPE, first produced by Imperial Chemical Company in 1933), high-density polyethylene (HDPE, originated after Carl Ziegler developed a new catalyst system in 1953), and linear low-density polyethylene (LLDPE, introduced with the help of a Ziegler-Natta catalyst technology in 1978). Among these key polyethylene types, HDPE accounts for the largest share of global PE production. Other PE products are as follows: medium-density polyethylene (MDPE), very low-density polyethylene (VLDPE), ethylene vinyl acetate (EVA), and polyolefin plastomers/elastomers. LDPE and LLDPE are mainly applied in the production of plastic films, while HDPE is widely used to produce containers, pipes, automotive components, pallets, toys, etc.

Polyethylene: structure of the global production by key types

The polyethylene market behaviour is currently strongly affected by the prevailing dynamics and trends of the global chemical industry, which continues to suffer from reduced demand in various consuming sectors and regions, an unbalanced relationship between supply and demand, poor margins, and persistent overcapacity. The influence of these factors is exacerbated by global political instability, rising inflation rates, and augmented energy costs, which weigh heavily on consumers, especially in Europe (China is likely to have entered a period of economic slowdown). Another major issue that might have a prolonged effect on the polyethylene market is the planned change in the EU’s packaging and packaging waste regulation aimed at the plastics industry in Europe. The current uncertainty related to this legislation preparation, especially with respect to the recyclability of plastics, is a big concern for multiple manufacturers of plastics.

Find a detailed analysis of the polyethylene market in the in-demand research report “Polyethylene (HDPE, LLDPE and LDPE): 2024 World Market Outlook and Forecast up to 2033”.