Aniline, also known as phenylamine or aminobenzene, is an aromatic amine compound within an important commodity value chain consisting of nitrobenzene, aniline, methylene diphenyl diisocyanate (MDI production is a major outlet for aniline) and polyurethanes. It is used in a wide range of applications, including the production of dyes, pharmaceuticals, biomedical items, antioxidants, and accelerators in the rubber industry and various derivatives for multiple industries. Different established aniline-manufacturing routes may involve benzene, nitrobenzene, chlorobenzene, phenol, ammonia, and toluene. Covestro has recently started the world’s first pilot project in Leverkusen (Germany) to produce aniline from bio-based feedstock. Covestro, formerly Bayer MaterialScience, is one of the world’s leading manufacturers of high-quality plastics and their components, including aniline. Covestro operates an aniline production capacity of 1,160,000 tonnes per year with facilities in Asia, Europe, and North America. With respect to aniline production, Covestro is outperformed only by BASF and followed by Huntsman.

Aniline exerts a major detrimental effect on both humans and wildlife due to its toxicity, carcinogenicity, and mutagenicity, which is an important constraining factor for aniline market development. Unsurprisingly, the U.S. Environmental Protection Agency (EPA) is currently developing new regulations to restrict the use of aniline via the so-called chemical safety programme, known as the Toxic Substances Control Act. Key chemical manufacturers in the USA expressed concerns that new regulations in the domain of the chemical industry may significantly raise the costs of chemical production in this country. The USA remains a major aniline manufacturer with a current aniline production volume of about 1 million tonnes per year.

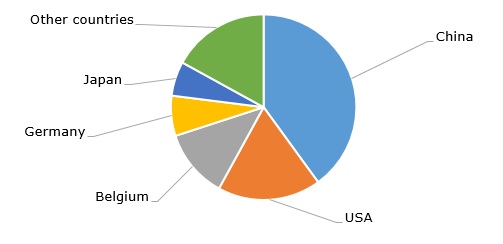

Aniline: structure of the global production by country, 2023

In addition to prohibitive regulations that might be imposed in the near future, the aniline market is adversely affected by the current unbalanced macroeconomic situation. The aniline market in Q1 2024 behaved better than in Q4 2023 when it was significantly affected by reduced demand, rising costs, and logistics issues. The market is still subdued owing to unfavourable supply and demand dynamics, as well as lower MDI average selling prices and diminished MDI sales volumes, which affected both aniline and MDI margins. Apart from the current challenging macroeconomic environment, aniline overproduction by MDI-related manufacturers, especially in China, has long been a factor constraining aniline market profitability and satisfactory cost performance. For instance, for this reason, Mitsui Chemicals terminated aniline production at its Ichihara Works back in 2009 and in 2024 decided to close the phenol plant there by no later than 2026.

Find a detailed analysis of the aniline market in the in-demand research report “Aniline: 2024 World Market Outlook and Forecast up to 2033”.