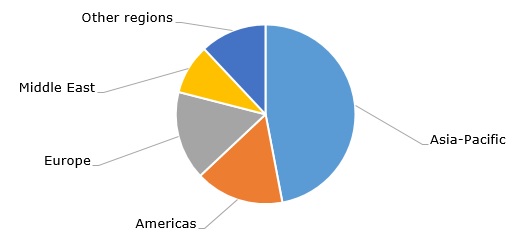

Ethylbenzene (EB) is an aromatic compound that is among the most popular building blocks in the chemical industry, together with benzene, toluene, and xylene. Ethylbenzene is traditionally produced by the alkylation of benzene with ethylene in the presence of a catalyst, while ethylbenzene is mainly used for the production of styrene. The latter is in turn converted to polystyrene, ABS resin, styrene-acrylonitrile, and other styrene products. Ethylbenzene is also used directly to manufacture pesticides, inks, solvents, motor fuels, asphalt, naphtha, paints, synthetic rubber, and other commodities. The global ethylbenzene production capacity exceeds 47 million tonnes per year, while nearly half of this capacity is located in Asia-Pacific, where China’s ethylbenzene production capacity reaches 14 million tonnes per year.

Ethylbenzene (EB): structure of the production capacity by region,2023

Ethylbenzene is classified as a hazardous chemical, which is acutely toxic to humans and the environment, including aquatic life, groundwater, and soils. The detrimental effect of ethylbenzene is long-lasting. In the future, ethylbenzene usage may be restricted within the framework of the U.S. chemical safety program, known as the Toxic Substances Control Act (the U.S. production volume of ethylbenzene amounts to approximately 5 million tonnes per year). Ethylbenzene is a possible candidate to be included in the evaluation process within this programme as this substance might pose an unreasonable risk. However, the level of this risk might be exaggerated because the bulk of ethylbenzene produced by the U.S. manufacturers is consumed internally by these manufacturers themselves, i.e. directly at their own enterprises producing styrene products. For example, at AmSty, which is a key producer of ethylbenzene, styrene, and polystyrene in the Americas, ethylbenzene is produced at its St. James, Louisiana plant, as a part of the styrene-manufacturing process. It is consumed mostly internally as the precursor for styrene monomer production, though certain amounts enter the markets of South America and Asia. In general, the U.S. exports of ethylbenzene are quite small and were worth just over USD 33 million in 2021. For comparison, European countries, like Belgium, the Czech Republic, or the UK, can export much bigger volumes of ethylbenzene (the ethylbenzene export value of these three countries exceeded USD 530 million in 2021).

Similar to the situation in the USA, the European polymer and chemical industries are currently worried about the planned adoption of the Packaging and Packaging Waste Regulation (PPWR), which is still confusing for polymer manufacturers and waste collection entities. This regulation will introduce massive changes to the way the recycling and packaging sectors operate. The PPWR will impose minimal recycling content requirements for packaging and will shift a lot of responsibility to producers, especially for package labeling and meeting specific recycling targets.

Sustainability looms large among all key producers of ethylbenzene, including such companies as LyondellBasell, Synthos, Versalis (Eni), and INEOS Styrolution. All these companies are engaged in various projects that encompass recycling (both chemical and mechanical) of plastic waste, circular economy, carbon footprint reduction, the use of renewable materials, and other innovative technologies in the domain of sustainability. Within this direction, for example, Versalis, Eni’s chemical company, will build a demo plant in Mantua to develop a proprietary technology, entitled Hoop, for chemical recycling of mixed plastic waste.

Find a comprehensive analysis of the ethylbenzene market in the insightful research study “Ethylbenzene (EB): 2024 World Market Outlook and Forecast up to 2033”.