Potassium hydroxide (KOH), also known as caustic potash, is a potassium salt that serves a wide range of end-use markets. These key end markets include the production of potassium carbonate and potassium phosphates, chemical intermediates, potassium salts, and other applications, such as fertilizers, soaps, detergents, dyes, pharmaceuticals, photographic chemicals, alkaline batteries, biodiesel, fabric glass, ceramics, de-icing fluids, water treatment, to name only a few.

Potassium hydroxide can be produced via electrolysis of aqueous potassium chloride or potassium carbonate with the help of mercury, membrane, or diaphragm process. Membrane cell technology is likely to dominate as ecologically hazardous mercury-based production technology used in the chlor-alkali industry should be phased out in accordance with the UN Minamata Convention on Mercury. The Convention sets the deadline for abandoning mercury use in chlor‐alkali production in 2025.

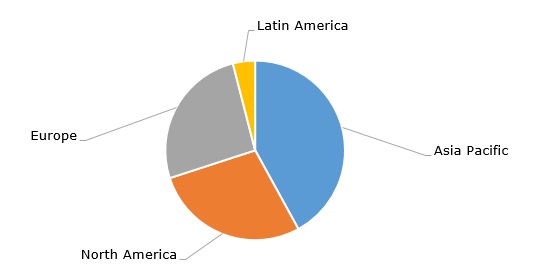

Potassium hydroxide: structure of the global production by region, 2023

The market for potassium hydroxide is almost fully divided between Asia Pacific, North America, and Europe. UNID Co. Ltd. (South Korea) is a global market leader in the production of potassium hydroxide with around 33% market share and the No. 1 position in China. The company operates potassium hydroxide production facilities in South Korea (in Ulsan) and China (in Jiangsu and Hubei provinces, as well as in Shanghai). In 2022, UNID invested in a new 180k mty KOH plant in Hubei Province (the Yichang Project) to strengthen its competitiveness in China after halting the Guang’an project in Sichuan Province due to environmental concerns. UNID’s facilities could also serve other markets. For instance, the company anticipates strong demand for its KOH from India in 2024.

The chlor-alkali industry is known to include such basic and versatile products as chlorine, caustic soda, sodium (bi)carbonate, potassium hydroxide, and potassium carbonate. In general, most KOH-producing entities within the chlor-alkali industry, for example, Esseco Group / Altair Chemical (Italy), Epigral (India), or ERCO Worldwide (Canada), operate as integrated facilities and consolidated businesses, manufacturing such products as caustic soda, chlorine, hydrochloric acid or potassium hydroxide. Such consolidation and integration allow to better combat the current market turbulence, associated with energy price fluctuations (KOH plants are known to be extremely energy intensive), demand reduction, logistics disruptions, and freight rising costs (e.g., due to the current risks in the Red Sea region). It is expected that demand may start to recover in 2024.

Sustainability looms large within the chlor-alkali industry, including caustic potash production. To illustrate the point, INEOS Group developed a New Ultra Low Carbon (ULC) range of chlor-alkali products, including potassium hydroxide. Such potassium hydroxide with a much lower carbon footprint (which is lower by 70% as compared to standard KOH) looks very attractive for multiple customers who wish to significantly reduce their scope 3 emissions.

Find a detailed analysis of the potassium hydroxide market in the in-demand research report “Potassium Hydroxide: 2024 World Market Outlook and Forecast up to 2033”.