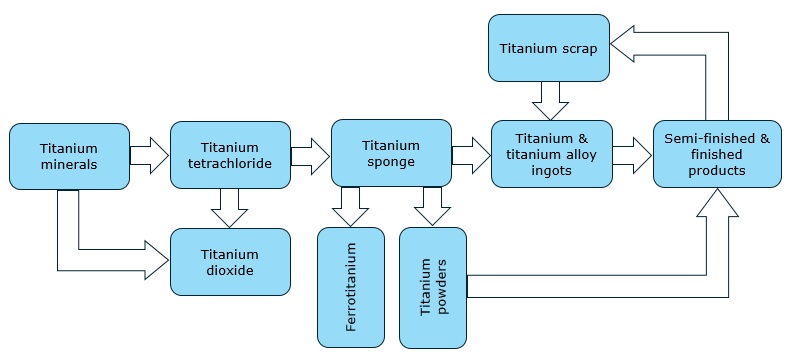

Titanium dioxide (TiO2) is an oxide of titanium and a mineral product that can be obtained from natural or synthetic sources. Natural titanium dioxide exists in three crystalline forms, i.e. anatase, rutile, and brookite. However, the bulk of pure titanium dioxide can be produced by purifying ilmenite ore, which is abundant in many countries. Several countries are the world’s largest producers of TiO2-containing minerals and account for the following shares of global titanium dioxide production: China (over 35%), Mozambique (12%), South Africa (10%), Australia (8%), Canada and Senegal (5% each). Titanium dioxide is intrinsically embedded in the complex value network of titanium products, which, in its simplified form, represents a pathway from TiO2-containing minerals to titanium sponges and ingots to semi-finished / finished products. Interestingly, manufacturing finished products produces significant quantities of titanium scrap, which can be brought back into the production of titanium ingots.

Simplified value chain of titanium products

Titanium dioxide is mainly used in the following groups of products: (a) paints, coatings, and pigments (over 57% of total TiO2 consumption), (b) plastics (23%), and (c) paper, synthetic fibres, and ceramics (18%). Other key titanium dioxide applications include cosmetics, food, pharmaceuticals (titanium dioxide of pharmaceutical grade is produced synthetically), disinfectants, and antimicrobials. Titanium dioxide of better quality is manufactured with the help of the chloride-based process, which implies the gas-phase oxidation of titanium tetrachloride (TiCl4), whereas the sulphate process means that the titanium-containing ore is dissolved in sulphuric acid. The latter process is known to be associated with increased levels of waste and pollution.

Key titanium dioxide manufacturers, including in China, have been phasing out the use of outdated sulphate technology. For example, US-headquartered Kronos Worldwide, Inc. intends to shut down its sulphate-based TiO2-producing facility in Varennes, Canada. The company reported that 2023 was a difficult year for the titanium products industry and for the company’s operation, which was affected by lower demand and prices for titanium dioxide, leading to its decreased sales and production volume. In 2023, titanium dioxide production by Kronos Worldwide stood at 401,000 tonnes as compared to 492,000 tonnes in 2022. In general, the US titanium dioxide production, which is open to significant fluctuations in production volume and prices, was 1.1-1.2 million tonnes in 2023. It is anticipated that H1 2024 will see improved profit margins and better titanium dioxide prices. In Q2 2024, US-headquartered Tronox, a major titanium dioxide manufacturer, plans to increase TiO2 production volume by 7-10% as compared to Q1 2024. The titanium dioxide market in Europe has also shown some signs of reinvigoration.

Find a comprehensive analysis of the titanium dioxide market in the in-demand research study “Titanium Dioxide: 2024 World Market Outlook and Forecast up to 2033”.