Acetone is an important chemical compound used in a wide range of commercial applications. It plays a prominent role as an intermediate to manufacture such chemicals as methyl methacrylate (MMA), bisphenol-A (BPA), and methacrylic acid, which are in turn applied to make plastics, acrylic products, sealants, lacquers, and epoxy resins. Production of solvents accounts for over a third of the global acetone demand. Acetone is consumed in the following end markets: personal care and cosmetics, car manufacturing, construction, textiles, electronics, pharmaceuticals, and the petroleum industry. The applicability of acetone is supported by its useful properties, including low boiling point, relatively non-toxic character, and miscibility in water, alcohol, dimethylformamide, ether, and other substances.

The most basic acetone manufacturing route includes the alkylation of benzene with propene and the oxidation of cumene to give phenol and acetone with the help of zeolite catalyst technology (the cumene route). From a sustainability perspective, benzene feedstock can be sourced from recycled plastic as was demonstrated by US firm Encina, while waste heat from chemical plants can be utilized and used for district heating, thus reducing carbon footprint (e.g. Ineos Phenol’s cumene-producing plant at Marl in Germany). The cumene route generates over 90% of global acetone production volume. Acetone production is closely associated with that of phenol as the bulk of acetone is produced as a by-product of phenol production. Other acetone manufacturing routes may include the direct oxidation of propylene, the isopropyl alcohol route, the so-called phenol process, or as a byproduct in the manufacture of various other chemical products, like propylene oxide and acetic acid.

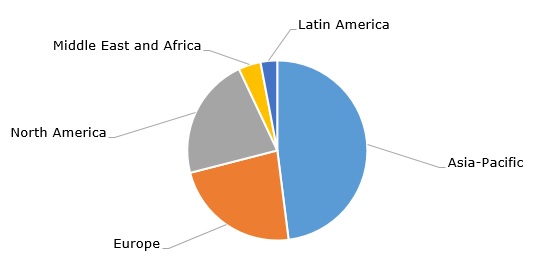

Acetone: structure of the global production capacity by region, 2023

Asia-Pacific accounts for the largest share of global acetone production capacity. The Asia-Pacific region looks promising, which can be illustrated by the acquisition by INEOS Phenol of the entire asset base from Mitsui Phenols on Jurong Island, Singapore, in 2023. This acquisition added 185 thousand tonnes to existing Ineos Phenol’s acetone production capacity, which exceeds 1.1 mln tonnes.

The current dynamics of the global acetone market are somewhat mixed as opposing trends often dominate the market. There is no fundamental shift in demand for acetone from multiple downstream sectors. In general, this demand stays restrained, though with some traces of recovery in H1 2024. The US and Asian acetone markets perform better than the European ones. Multiple issues with logistics and trade routes still exist, especially owing to the delays in the Suez Canal due to the conflict in the Red Sea region and the Panama Canal because of a drought that caused low water levels. The cost of benzene feedstock remains high, which is compensated by weaker demand. However, acetone prices started to firm in H1 2024.

Find a detailed analysis of the acetone market in the in-demand research report “Acetone: 2024 World Market Outlook and Forecast up to 2033”.