Styrene acrylonitrile (SAN) is a versatile engineering thermoplastic copolymer of styrene and acrylonitrile. Styrene monomer is obtained mostly via the dehydrogenation of ethylbenzene, while acrylonitrile is manufactured by combining propylene, ammonia, and air via an ammoxidation process. Over 95% of globally produced acrylonitrile is manufactured with the help of the technology developed by INEOS. Renewable feedstock (up to 70% of the total content) can be mixed with fossil feedstock to produce the ingredients for SAN copolymers, thus significantly (by over 90%) reducing carbon footprint.

In general, polystyrene and its copolymers, often referred to collectively as styrenics, comprise a large group of plastics. The other two large groups of plastics are polyolefins and polyvinyl chloride. Among the most important styrene polymers are acrylonitrile-butadiene-styrene copolymers (ABS), styrene acrylonitrile copolymers (SAN), high impact polystyrene (HIPS), styrene butadiene rubber (SBR), and blends of ABS and HIPS with polyphenylene oxide and polycarbonate. The polymer physics and engineering communities are never short of efforts to develop new, advanced materials and technologies related to the domain of styrenics. Likewise, major styrenics manufacturers are constantly expanding their portfolios of product grades. For instance, in May 2024, Ineos Styrolution introduced a new SAN solution, specifically suited for ABS compounding, under its famous Luran brand of styrene acrylonitrile copolymers. Luran has been developed in cooperation with BASF.

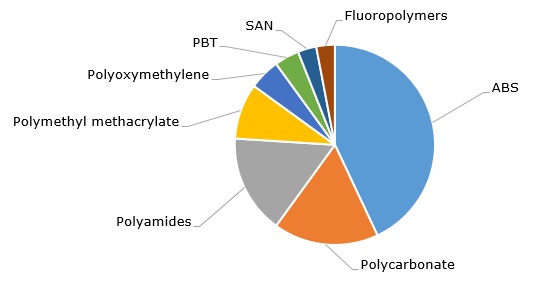

The SAN market is characterised by substantial production overcapacity, which might be primarily attributed to Asia and recent capacity additions in this region. These additions happen despite the fact that demand for SAN among other engineering plastics is not significant and accounts for just 3% of global demand for such plastics.

Structure of the global demand for engineering plastics, by type

Moreover, this overcapacity is characteristic of nearly all products along the styrenics value chain, starting from styrene itself. For example, under global styrene consumption of around 30-32 million tonnes per year, styrene production capacity exceeds 43-43 million tonnes per year. Such kind of overcapacity triggers ongoing debates about the need for some form of economic degrowth.

Find a detailed analysis of the styrene acrylonitrile market in the in-demand research report “Styrene Acrylonitrile (SAN) 2024 World Market Outlook and Forecast to 2033”.