Vinyl chloride monomer (VCM) is an important chemical intermediate mainly utilised in the production of polyvinyl chloride (PVC). PVC is one of the world’s most widely used polymers, after polyethylene and polypropylene. Despite the ongoing PVC oversupply, demand for this polymer has been increasing by an average rate of 0.7-1 million tonnes per year. Currently, PVC production volume hits 58 million tonnes per year, while global demand for PVC stands at about 50 million tonnes per year (China accounts for almost 50% of this demand). Global VCM production capacity has grown from 7.9 million tonnes in 2015 to over 9 million tonnes in 2023.

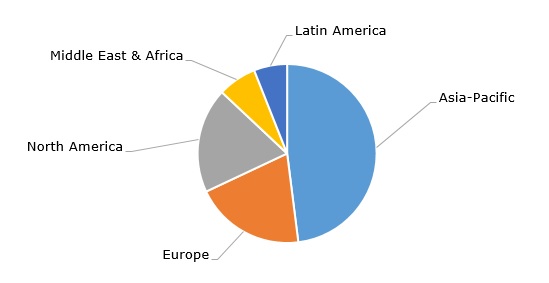

Vinyl chloride monomer (VCM): structure of the global production capacity by region, 2023

Originally obtained via the chemical reaction between 1,2-dichloroethane and potassium hydroxide, VCM can be produced by a range of manufacturing routes. For example, various Chinese producers, supported by strong availability of coal resources, prefer to use acetylene (derived from coal-extracted calcium carbide) and hydrogen chloride (this method was patented by Chemische Fabrik Griesheim-Elektron over a century ago). Research into other VCM-manufacturing technologies has been gaining momentum. However, the acetylene-based manufacturing route is now considered outdated and less environmentally friendly. Therefore, the use of ethylene, obtained from ethane cracking (this might be facilitated by the availability of cheaper shale gas in the US), is a preferred VCM production method. To this extent, ethylene cost is an important factor in the VCM market. For instance, in late 2023, OxyChem, which is one of the three main US manufacturers of PVC and VCM, reported a decrease in income, primarily due to high ethylene costs.

The PVC market, known for its dependence on the construction sector, may be affected by the current economic slowdown in Europe (esp. in Germany), China (esp. in the construction industry due to China’s property bubble), and other regions. Among numerous factors, that could potentially influence the VCM market, one can mention the tightening of the environmental regulation by the US Environmental Protection Agency (EPA) in relation to VCM (VCM is currently under toxicity-related review by the EPA). This may lead to raising manufacturers’ expenses of compliance with these regulations, though major VCM-producing companies probably will not be significantly impacted.

Shintech Inc. (US), a subsidiary of Shin-Etsu Chemical Co. (Japan) and the world’s leader in VCM production, is known for its steady VCM production capacity expansion. The current VCM-producing capacity by Shintech accounts for 2.95 million tonnes per year. Shin-Etsu is also the world’s largest producer of PVC with a total production capacity of 4.4 million tonnes per year (located in the US, Europe, and Japan). Shintech’s VCM capacity expansion is also a strategic decision to develop vertical integration and raise feedstock supply security within its chlor-vinyl segment. This decision might prevent situations when dependence on another company for VCM supply could lead to litigation, such as the one between Shintech and Olin (and its subsidiary) a year ago over a failure of the latter to supply VCM to Shintech’s plant in Freeport (Texas). So, vertical integration is an important trend in the market for chlor-vinyl products.

Find a detailed analysis of the vinyl chloride monomer market in the in-demand research report “Vinyl Chloride (VCM): 2024 World Market Outlook and Forecast up to 2033”.