Polyphenylene oxide (PPO) or polyphenylene ether (PPE, also known as modified polyphenylene ether, mPPE) are thermoplastic polymers obtained via step-growth polymerization reactions and specifically via oxidative polymerization of 2,6-disubstituted phenols. Polyphenylene oxide forms blends or alloys with other polymers, such as polystyrene, polyamide, polypropylene, and styrene-ethylene-butylene-styrene copolymer. Apart from other benefits, blending with other polymers assists in improving PPO processability, which traditionally suffers due to the high melt viscosity of polyphenylene oxide. For example, PPE/PS blends manufactured by German compounder Romira GmbH under the tradename LURANYL possess excellent processability both by injection molding and extrusion. This Luranyl-based business in Germany and South Korea was once owned by BASF, but it was sold to Romira in 2002 because BASF was more interested in high-volume thermoplastics.

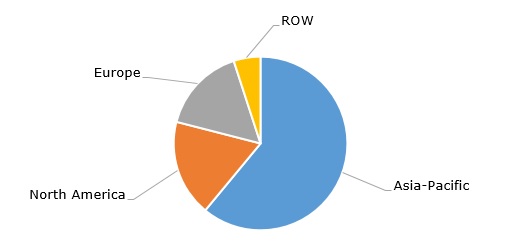

Current demand for polyphenylene oxide amounts to 400-450 thousand tonnes per year, while PPO sales can reach USD 1.8 billion per year in the near future. Asia-Pacific (esp. China) is the largest market for polyphenylene oxide, though China’s PPO production capacity is only around 50 thousand tonnes per year. PPO commercialization actually started in 1964. In 1966, General Electric Plastics began to commercialise polyphenylene oxide under the tradename NORYL (General Electric Plastics and the NORYL family of polyphenylene oxide are now owned by SABIC). NORYL was followed by Prevex PPO resins developed by Borg-Warner Chemicals in the 1980s.

Polyphenylene oxide: structure of the global demand by region

Owing to optimal electrical, chemical, mechanical, and thermal characteristics, (e.g. adequate electrical insulation, good chemical resistance, high hydrolytic stability, improved heat/impact resistance, excellent dimensional stability, etc), polyphenylene oxide finds application in automotive, communication, and IT, electrical, electronic, medical, energy, air separation, household appliance, office, housing, and other sectors. Polyphenylene oxide is widely used to make various electronic and electrical components for both industrial and consumer markets, including for the most advanced sectors. For example, SABIC uses NORYL GTX resins, which are blends of polyamide and modified polyphenylene ether, to make new types of EV chargers, apart from other products. Likewise, Asahi Kasei’s PPE, which is marketed under the tradename SunForce, is widely used in EVs. In general, electric vehicles and other high-value-added electronic products are strong drivers that assist in developing the market for PPO/PPE-based materials. The current slowdown in the electric vehicle market is a concern of the polyphenylene oxide sector. Despite this slowdown, LG Chem, which manufactures PPE/PPO under the tradename Lumiloy, recorded steady growth in its Advanced Materials division in H1 2024. In conclusion, the underlying trends of the market for PPE/PPO products will hinge on their enhanced functionality, further customization, and SDG compliance. The latter will focus on the circularity of the polymer industry and reduction in environmental impacts based on the implementation of life cycle assessment tools, which is exemplified, for instance, in the sustainability strategies of LG Chem.

Find a comprehensive analysis of the polyphenylene oxide market in the in-demand research report “Polyphenylene Oxide (PPO, PPE) 2024 Global Market Review and Forecast to 2033”.