Polyvinyl chloride (PVC) is an amorphous thermoplastic polymer with significant functional versatility that spreads to nearly all industries, including electrical engineering, construction, agriculture, healthcare, automobiles, toys, clothing, footwear, packaging, etc. This makes PVC the world’s third most widely used plastic. Such versatility is safeguarded by the relative easiness of PVC processability with the help of various methods, such as extrusion, injection/blow moulding, calendaring, pressing, and sintering. Polyvinyl chloride applicability also broadens when copolymers, plasticizers (possibly bio-based), stabilisers, lubricants, colourants, or fillers are added to it, thus resulting in specialty materials with advanced properties. PVC is manufactured using suspension polymerization (a predominant method, which generates a fairly pure material) and emulsion polymerization.

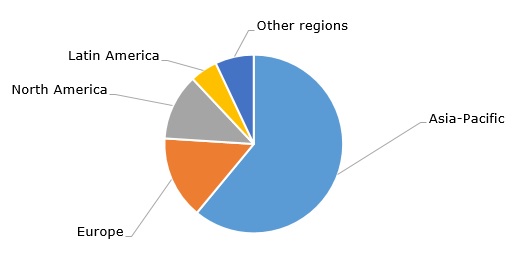

Global PVC production capacity exceeds 60 million tonnes per year, while the global market for PVC is valued at over 70 billion U.S. dollars per year. Asia Pacific accounts for the largest share of total PVC consumption.

Polyvinyl chloride (PVC): structure of the global consumption by region, 2023

The PVC market suffers from tangible overcapacity, experiences severe competition, and encounters environmental challenges. Therefore, various governments adopted stringent environmental measures to regulate the PVC market, especially in Europe. Demand for PVC has dropped during the 2007-2008 financial crisis and has been subdued since then. The current macroeconomic (e.g., the Chinese property sector crisis) and geopolitical issues could only exacerbate the situation. In 2023 and H1 2024, demand for general-purpose and specialty PVC was weak, PVC prices dropped, and PVC imports from China increased. Despite strong competition from Chinese manufacturers, Shin-Etsu, which is the world’s largest PVC producer, raised its PVC prices.

The PVC demand drop can persuade some manufacturers to choose more upstream products within the vinyls chain, like ethylene dichloride (EDC, which originates by reacting chlorine with ethylene) and vinyl chloride monomer. Though companies use the bulk of produced EDC for PVC, EDC can be used separately, for example, as an intermediate for other organic substances. Another strategy is to gradually exit the highly cyclical PVC business as Solvay did in several steps. In 2014, Solvay sold its PVC compound business. Further, in 2016, Solvay stepped out of a joint venture with INEOS, the INOVYN Business, which was a leading player in the global PVC market, particularly in the specialty PVC market. In 2023, Solvay sold its stake in RusVinyl.

Just on the contrary, Ineos demonstrates its commitment to PVC products, especially specialty PVC and related sustainable solutions. This includes innovative PVC products with reduced carbon footprint (e.g., products made under the trademark of NEOVYN) or large-scale PVC recycling. Ineos aims to make all PVC waste recyclable with its PVC-recycling industrial unit ready by 2030. Orbia (formerly Mexichem), which is the largest polyvinyl chloride producer in Latin America, follows suit with multiple sustainable initiatives. Robust plans to develop the vinyl products chain were expressed by Qatar Vinyl Company (QVC) and Westlake. So, QVC will build a new 350k mty PVC plant in Qatar by H2 2025, while Westlake continues to expand and maintain its PVC production capacity in North America, Europe (via Westlake Vinnolit) and China (via Westlake Huasu Suzhou Co.).

Find a detailed analysis of the polyvinyl chloride (PVC) market in the in-demand research report “Polyvinyl Chloride (PVC): 2024 World Market Outlook and Forecast up to 2033”.