Methyl tertiary butyl ether (MTBE) belongs to the class of oxygenates, which also includes ethyl tertiary butyl ether (ETBE), tertiary amyl methyl ether (TAME), tertiary amyl ethyl ether (TAEE), and ethanol. Oxygenates are used as octane boosters to raise the combustion efficiency of motor vehicle fuel and to replace highly toxic compounds (e.g. tetraethyl lead, carbon monoxide, and volatile organic carbon), thus reducing a detrimental effect on the environment and human health. Despite this positive effect, MTBE also poses significant risks to the environment and humans. MTBE is volatile and soluble, as well as more resistant to natural degradation than other gasoline components. Besides, some experiments demonstrated that it potentially might act as a carcinogen. Methyl tertiary butyl ether is manufactured from natural gas-derived tertiary butyl alcohol (TBA, which is converted to isobutylene) and methanol. Bio-based MTBE is also available.

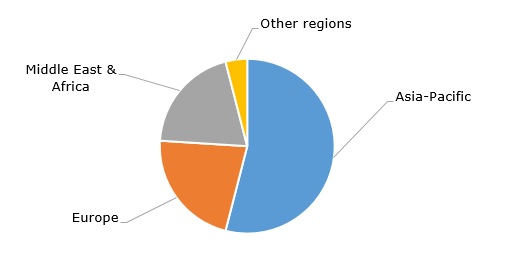

Almost two decades ago, the US Congress passed the Energy Policy Act that removed the oxygenate requirement for gasoline and instituted a renewable fuel standard, which resulted in MTBE phase-out from fuel blends and substituting it with ethanol and ETBE. Following this decision, US imports of MTBE from Saudi Arabia have plummeted from 6 million barrels per year in the early 2000s to almost negligible levels now. Currently, MTBE use in transport fuels as an oxygenated additive is banned in several countries, but it is allowed in other countries. It is not prohibited to use MTBE for various industrial and similar applications (e.g. as a laboratory solvent or in medicine and production of other chemicals). Despite environmental and other concerns regarding MTBE safety, its expansion to Asia Pacific markets has been increasing, and this region accounts for the largest share of MTBE demand. The current MTBE production capacity is about 36 million tonnes per year, though the actual output is much lower.

Methyl tertiary butyl ether (MTBE): structure of the global demand by region

The current dynamics of the MTBE market is driven by several factors. As alluded to before, the growing importance of environmental and safety concerns is a major factor. The MTBE market remains highly seasonal with a vivid boost around summertime. In late Q2 and early Q3 2024, seasonal factors supported stable MTBE prices. As for MTBE feedstock, such as methanol, its price showed an upward trend, driven by reduced supply and healthy demand in Asia Pacific. Some MTBE producers exhibited mixed sentiments in relation to MTBE prospects. For example, in 2023, LyondellBasell launched the world’s largest propylene oxide (470k mty) and TBA (1 mln mty) production facility in Channelview, Texas. This facility is associated with LyondellBasell’s ethers unit (at the Bayport Complex, Pasadena, Texas), which is responsible for TBA processing to oxyfuels. However, in 2024, LyondellBasell sold its ethylene oxide and derivatives business in Bayport to INEOS Oxide.

Find a detailed analysis of the MTBE market in the in-demand research report “Methyl Tertiary Butyl Ether (MTBE): 2024 World Market Outlook and Forecast up to 2033”.