Adipic acid is a dicarboxylic acid used as a chemical intermediate in the production of various important products. Its primary application is in the manufacture of nylon-66 and nylon-6 fibres, which account for up to 80% of adipic acid consumption. Additionally, adipic acid is used to make adipic acid esters (e.g., employed as plasticizers for PVC) and polyurethane resins. These chemical compounds are used in a wide range of products, including coatings, lubricants, detergents, paints, insect repellents, food products (e.g., food additives and acidulants), construction materials, and more.

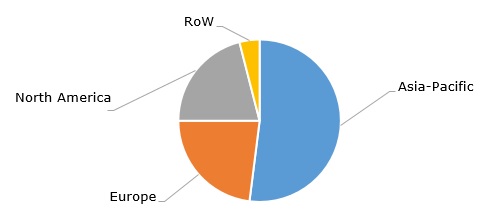

The market volume of adipic acid increased from 3.9 million metric tonnes in 2018 to over 4.5 million metric tonnes in 2023, which is relatively modest given the already oversupplied market. Its projected value will exceed USD 10 billion by 2032. The Asia-Pacific region accounts for the largest share of global adipic acid production.

Adipic acid: structure of the global production by region

Adipic acid is traditionally produced through a series of reactions involving the oxidation of cyclohexane or benzene with nitric acid to form a cyclohexanone/cyclohexanol mixture, which is then converted into adipic acid. However, the industrial production of adipic acid raises significant environmental concerns due to the generation of nitrous oxide as a byproduct. Nitrous oxide emissions are a major human-caused contributor to ozone depletion. These emissions depend on various factors, including the composition of the feedstock used in adipic acid production. Bio-based adipic acid, derived from renewable sources, is known to significantly reduce greenhouse gas emissions compared to conventional adipic acid. However, the economic feasibility of the large-scale production of bio-based adipic acid remains a challenge. Nevertheless, efforts to use bio-based, circular, and bio-circular feedstocks to produce adipic acid were recently recognized when INVISTA’s manufacturing site in Victoria, Texas, received International Sustainability and Carbon Certification (ISCC) PLUS certification. INVISTA’s adipic acid plant in Victoria has a capacity of 360,000 metric tonnes per year. In 2015, INVISTA shut down its production facility in Orange, Texas, which had an annual capacity of 220,000 metric tonnes of adipic acid.

The current dynamics of the global adipic acid market are influenced by several factors: production overcapacity, particularly in the Asia-Pacific region; a decline in demand across various consuming sectors, primarily nylon; and pressing environmental concerns. European manufacturers appear especially vulnerable due to their exposure to stricter environmental regulations, rising costs, and ongoing macroeconomic uncertainty. Additionally, a lack of clarity regarding environmental regulations complicates corporate planning and business operations. Unsurprisingly, these conditions contributed to BASF’s decision to cease adipic acid production at its 300,000 metric tonnes per year facility in Ludwigshafen, Germany, in 2025. BASF will continue to produce adipic acid at its facilities in Onsan, South Korea (acquired from Solvay in 2019), and through its joint venture in Chalampé, France. The latter is operated by a JV between BASF and Domo Chemicals.

Find a detailed analysis of the adipic acid market in the in-demand research report “Adipic Acid (ADPA): 2024 World Market Outlook and Forecast up to 2033”.