Chlorine is an essential chemical intermediate, deeply integrated into the value chain of chlorinated compounds and chlor-alkali products. The chlor-alkali industry exists as a co-production system for chlorine and sodium hydroxide (caustic soda) because chlorine manufacturing traditionally involves the electrolysis of salt-water brine, which leads to the separation of these two products, along with hydrogen as a by-product. Historically, the use of saltwater brine required chlorine production facilities to be located near natural salt deposits.

Chlor-alkali electrolysis is an extremely energy-intensive process. For example, in Germany, it accounts for 2% of the country’s total electricity consumption, which is the largest share among individual sectors of the German chemical industry. Consequently, efficient energy management in chlorine production facilities should be a top priority. To illustrate, Nobian (spun off from Nouryon in 2021) produces all its ISCC PLUS-certified chlorine using 100% renewable energy in the Netherlands and Germany, significantly reducing its carbon footprint.

Chlorine is primarily used in organic compounds (e.g., isocyanates and oxygenates), inorganic chemicals, and chlorine derivatives [e.g., ethylene dichloride (EDC), vinyl chloride monomer (VCM), and polyvinyl chloride (PVC)], as well as in the pulp and paper industry and water treatment. Its use for cleaning, disinfecting, and antiseptic purposes is also widespread. The modern chlor-alkali industry plays a vital role in the production of various end-products, including agrochemicals, automotive components, construction materials, electronics, solvents, paints, textiles, refrigerants, pharmaceuticals, consumer goods, and more. However, some of these sectors (e.g., construction, automotive, etc.) are significantly affected by current macroeconomic factors, such as high interest rates and economic uncertainty, which negatively impact demand for chlor-alkali products like PVC.

In 2023, the global market volume of chlorine exceeded 100 million metric tonnes, with steady annual growth of 4-5% worldwide. However, chlorine production in Europe has experienced significant fluctuations, rather than consistent growth. U.S. chlorine production has remained nearly flat since 1990. As of 2023, Olin Corporation operated the largest chlor-alkali production capacity in both North America and globally. Chlorine production capacity in North America stands at 16 million metric tonnes per year. In the same year, Canada emerged as the world’s leading exporter of chlorine, with exports valued at 139.5 million U.S. dollars.

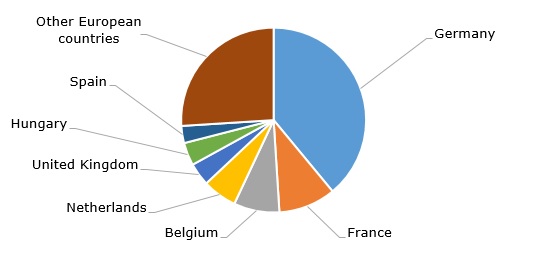

Chlorine: structure of the global production capacity in Europe, by country

Chlorine production in Europe reached approximately 7.3 million metric tonnes in 2023, with Germany leading by a wide margin in production capacity. As of 2023, Germany’s chlorine production capacity exceeded 5.4 million metric tonnes, with Dow, Covestro, and BASF as the leading chlorine manufacturers in that country. The top five chlorine producers in Europe are Dow, Covestro, INEOS, Nobian, and Kem One, with European production capacities of 1.877, 1.48, 1.414, 1.14, and 0.674 million metric tonnes per year, respectively.

Despite its growth, the chlor-alkali industry has often been associated with various environmental issues. These include concerns related to chlorinated pesticides, chlorofluorocarbons (CFCs) contributing to ozone depletion, and the use of environmentally harmful chlorine-manufacturing processes such as the asbestos-based diaphragm method or the mercury cell method. The use of the mercury cell process has now been phased out in Europe.

Find a detailed analysis of the chlorine market in the in-demand research report “Chlorine (CL): 2024 World Market Outlook and Forecast up to 2033”.