Potassium sulphate (K₂SO₄), also known as sulphate of potash (SOP), is regarded as a premium specialty fertilizer rich in potassium. It contains potassium (50% K₂O) and sulphur (18%) and is notable for its low chloride content, which is essential for fruit crops sensitive to chloride toxicity. SOP is particularly well-suited for use in saline soils and is highly effective in addressing sulphur deficiencies. These deficiencies have become a widespread issue globally due to intensive agricultural practices and the increasing use of sulphur-free fertilizers.

The benefits of potassium sulphate are well-documented, including its ability to enhance plant morphology and improve fruit quality, especially when applied as part of a well-balanced nutritional plan. Despite its advantages, potassium sulphate remains relatively expensive and is impacted by regulatory efforts to limit atmospheric sulphur dioxide emissions. For example, in Q3 2024, SOP was traded at EUR 567-632 per metric tonne (FOB, Western Europe). For comparison, potassium chloride, also known as muriate of potash (MOP), was over twice as affordable during the same period. In Q3-Q4 2024, both the prices of potash-containing products and their sales volumes were lower than anticipated. Consequently, some major SOP manufacturers, such as K+S, reported weaker performance compared to the same period in the previous year.

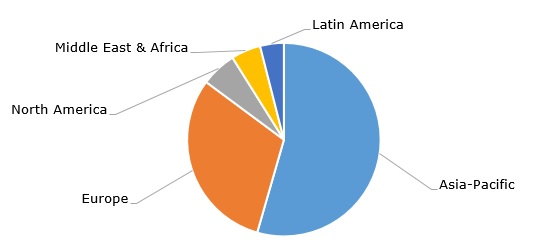

Overall, the market for potash-containing products is characterized by significant volatility, driven by multiple macroeconomic factors. For example, the combined production of potassium chloride and potassium sulphate by Sociedad Química y Minera de Chile S.A. (SQM) declined from 1.41 million metric tonnes in 2021 to 0.984 million metric tonnes in 2022, before recovering to 1.21 million metric tonnes in 2023. The Asia-Pacific region, led by major potassium sulphate producers such as SDIC Xinjiang Luobupo Potash Co., Qing Shang Chemical Group, and Migao Group, dominates the global potassium sulphate market.

Potassium sulphate: structure of the global production capacity, by region

The production of potassium sulphate from secondary sources (i.e. as a by-product of various industries) poses additional challenges, as it involves complex processes and requires the disposal of hydrochloric acid (HCl). Primary production of potassium sulphate, on the other hand, relies on mining brine deposits from salt lakes or mining seaborne SOP (e.g. Agrimin’s Mackay potash project in Australia). These limitations influence the consumption patterns of potash fertilizers by type, with MOP accounting for the largest share (56%), followed by NPK compound fertilizers (36%). Potassium sulphate ranks third, representing only 3.5% of global potash fertilizer consumption.

However, the challenges in the potassium sulphate market also create opportunities for innovation. For instance, the Swedish company Cinis Fertilizer produces environmentally friendly SOP using a circular and sustainable approach. The company sources sodium sulphate from various industries where it would otherwise be considered waste. All production is powered by fossil fuel-free electricity and relies on recycled water. Additionally, Cinis Fertilizer mitigates environmental pollution and avoids the generation of hazardous by-products such as hydrochloric acid. The company has an operational target of running six production plants with a total annual production capacity of 1.5 million metric tonnes of potassium sulphate by 2030. Currently, Cinis Fertilizer is planning to launch its first U.S. plant in Kentucky by 2026. The plant’s production capacity will be 300,000 metric tonnes per year.

Find a detailed analysis of the detailed analysis of the potassium sulphate market in the insightful research “Potassium Sulphate (SOP): 2024 World Market Outlook and Forecast up to 2033”.