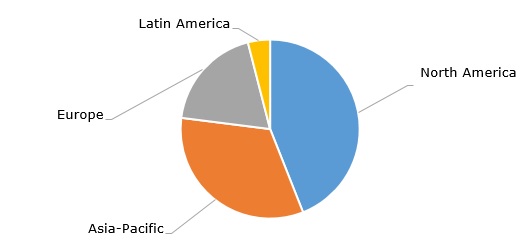

Calcium chloride (CaCl2) is an inorganic salt used across a wide range of applications. It is essential for de-icing and anti-icing purposes, as well as oilfield and water treatment. In the food processing industry, calcium chloride plays a key role in the production of cheese, beverages, and ice cream. In agriculture, it supports animal feed, provides calcium nutrition for crops, improves soil, and extends the shelf life of fruits and vegetables. In construction, it reduces concrete setting time, suppresses dust on unpaved roads, and stabilizes road bases for new construction projects. It is also used in metallurgy for the production of ferrous and non-ferrous metals and has applications in the tire industry and other specialized uses. For example, 1PointFive, a company established by the US company OxyChem, captures carbon dioxide and stores it through subsurface saline sequestration, which is connected to calcium chloride extraction from salt brines. The captured carbon dioxide can be later traded in the form of credits, exemplified by the carbon dioxide removal credit agreement as of 2024 between 1PointFive and Microsoft. OxyChem claims to be the world’s largest producer of calcium chloride (headquartered in Dallas, OxyChem is a subsidiary of Oxy, an international energy company). In general, North America accounts for the largest share of calcium chloride production capacity.

Calcium chloride: structure of the global production capacity, by region

Calcium chloride can be customized to meet the requirements of various applications. Different companies produce calcium chloride in both liquid and solid forms, including flakes, pellets, and powders, using a variety of manufacturing methods. Firstly, calcium chloride can be extracted from naturally occurring brines. Ward Chemical uses Calling Lake in Canada, while OxyChem extracts calcium chloride from brines at Ludington, Michigan. OxyChem purchased the Ludington calcium chloride business from Dow in 2009. Secondly, calcium chloride can be obtained with the help of the limestone-hydrochloric acid process. For instance, TETRA Technologies Inc. employs this method. TETRA’s total calcium chloride production capacity is 1 million equivalent liquid tonnes per year. Thirdly, calcium chloride can be derived as a by-product of the Solvay process, which is a key method for producing soda ash (e.g., Qingdao Haiwan Group Co., Ltd.).

In 2024, global consumption of calcium chloride amounted to around 5 million metric tonnes and will continue to steadily grow by 170-200 thousand metric tonnes per year. Of course, various exogenous shocks, such as the COVID-19 pandemic’s impact on the calcium chloride market, may disrupt the steadiness of this growth. In general, the market for calcium chloride is characterised by a very consistent growth rate, primarily driven by the versatility and unique properties of this chemical compound, as well as by its relative inexpensiveness when compared to alternatives. In Q4 2024, calcium chloride prices ranged widely from USD 160 to USD 320 per metric tonne, depending on product characteristics, region, and terms.

China remains the world’s largest exporter of calcium chloride. In 2023, China exported over 1.36 million metric tonnes of calcium chloride with a value of about USD 281 million. In 2024, China’s calcium chloride exports decreased as compared to 2023. In 2023, other major calcium chloride exporter countries included the USA, Netherlands, Egypt, Czechia, Mexico, India, and Finland. However, China surpasses all these countries in calcium chloride export volumes by a wide margin.

Find a detailed analysis of the calcium chloride market in the in-demand research report “Calcium Chloride (CaCl2): 2024 World Market Outlook and Forecast up to 2033”.