Ammonia (NH3) is an essential raw material for urea production and a key component in the manufacturing of various other fertilizers, such as DAP, NPK, ammonium nitrate, and others (ammonia can be directly applied to soil as a plant nutrient as well). Beyond agriculture, ammonia is widely used in various industrial applications, including traditional uses in the production of caprolactam, acrylonitrile, nitric acid, and melamine. It also plays a role in refrigeration, metal treatment, textiles, pharmaceuticals, cleaning agents, explosives, glues and more. Additionally, ammonia has emerging applications in areas such as energy storage, power generation, and as a transport fuel. Overall, the agricultural sector accounts for the bulk of the global ammonia demand.

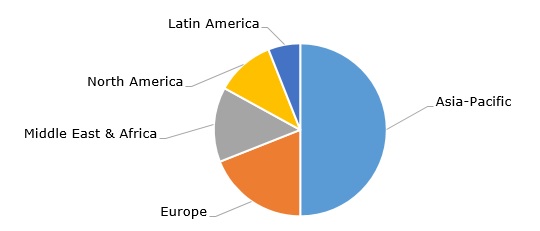

Current ammonia production is around 180 million metric tonnes per year, significantly lower than its annual production capacity of approximately 230 million metric tonnes. The ammonia market is valued at nearly USD 80 billion. Asia Pacific accounts for the largest share of global ammonia production capacity.

Ammonia: structure of the global production capacity by region

The ammonia market is heavily influenced by various factors, including supply and demand dynamics, (characterized by notable excess capacity and large specificity of demand subject to a region and application sector), feedstock costs, price volatility, macroeconomic and financial conditions, trade policies of individual countries, (just a small fraction of produced ammonia is traded, mostly via contracts), environmental regulations, seasonality (e.g., weather conditions and seasonal prices), and other considerations.

The most widely used method for ammonia production is steam methane reforming (SMR) combined with the Haber-Bosch process. This approach utilizes natural gas (methane) to produce hydrogen, which is then reacted with nitrogen extracted from the air to form ammonia. However, this method is highly energy-intensive and accounts for approximately 1% of global carbon dioxide emissions (about 1.7-2 tonnes CO2e per tonne of ammonia). To address these environmental challenges, manufacturers are striving to produce ammonia in a more sustainable and circular manner. For instance, they are incorporating renewable energy into the production process, using carbon capture and storage technologies or utilizing by-product hydrogen from ethane crackers.

These innovative practices have led to the emergence of terms such as “clean,” “green” and “blue” ammonia, as opposed to traditional “grey” ammonia. It is projected that clean ammonia could account for 13% of the global ammonia supply by 2030. For example, SABIC Agri-Nutrients Company has been producing the so-called low-carbon ammonia with a significantly reduced carbon footprint compared to the SMR method. In 2024, the Ministry of Energy of Saudi Arabia provided SABIC Agri-Nutrients with feedstock for the construction of a sixth plant, which will produce 1.2 million metric tonnes of low-carbon ammonia annually. As of 2022, SABIC Agri-Nutrients operated a total capacity of 1.16 million metric tonnes per year for low-carbon ammonia production.

Another example of low-emission ammonia production is Yara, a leading global agricultural and chemical company, which utilizes biomethane for this purpose. Yara produced 7.9 million metric tonnes of ammonia in 2024, with a target of reaching 8.6 million metric tonnes in 2025. This was surpassed by CF Industries, which expects to achieve a gross ammonia production of approximately 9.8 million metric tonnes in 2024.

Find a detailed analysis of the ammonia market in the in-demand research report “Ammonia: 2025 World Market Outlook and Forecast up to 2034”.