Liquid crystal polymers (LCPs) constitute a class of specialty thermoplastic polymers and super engineering plastics. They exhibit properties characteristic of both an ordered solid and an isotropic liquid. In other words, under certain conditions, LCPs behave like crystals while simultaneously displaying a degree of fluidity. This unique behaviour is due to a phenomenon known as mesomorphism, which imparts LCPs with high mechanical and tensile strength, as well as distinctive thin-wall flowability. These characteristics make LCPs particularly well-suited for precision injection moulding. In addition, LCPs possess inherent flame retardancy, excellent thermal stability, outstanding chemical resistance, and superior vibration-damping capabilities. As a result, they can outperform many other engineering plastics across a range of performance metrics. For example, the flammability characteristics of SUMIKASUPER-brand LCPs, produced by Sumitomo Chemical, surpass those of nearly all amorphous and crystalline polymers, including PPS and PEEK.

This highly efficient combination of properties has driven the application of LCPs in electrical and electronic components, optical and medical devices, composite materials, and high-performance fibres. LCPs are particularly vital to the telecommunications sector – especially in 5G technology – where they can be used in high-frequency communication equipment. Well-known LCP brands include Xydar (Syensqo, a spin-off from Solvay), Vectra/Zenite (Celanese), Siveras (Toray Industries, Inc.), LAPEROS (Polyplastics/Daicel Group; in 2024, the company began producing LAPEROS LCP using biomass-derived materials to reduce CO₂ emissions), UENO (Ueno Fine Chemicals Industry Ltd.) and SUMIKASUPER (Sumitomo Chemical). Each brand typically offers a variety of LCP grades that can be customized to meet specific application requirements. Polyplastics (Daicel Group) holds approximately 31.5% of the global LCP market, making it the world’s largest LCP producer.

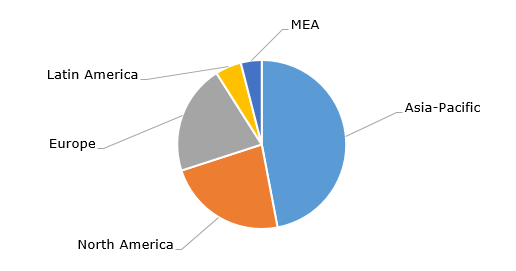

Liquid crystal polymers market size, by region

The global market for liquid crystal polymers is valued at approximately 1.3 billion U.S. dollars, with current annual production estimated at around 70-75 thousand tonnes. The global LCP market is projected to grow at a rate of 3-5% per year. Ongoing issues such as erratic on-off U.S. tariff policies, economic uncertainty, reduced profit margins in the chemical sector, and declining oil prices may significantly impact trade flows of aromatics and engineered polymer materials between regions. However, slower economic growth – particularly in China and Europe – was already evident prior to the current trade tensions. Prices for LCPs in the U.S. are currently on the rise. For example, as of early March 2025, Celanese increased prices for its liquid crystal polymers of Vectra and Zenite brands across all regions, including the U.S., by USD 0.10-0.50 per kilogram, depending on the region. U.S.-listed shares of Celanese fell sharply, following a significant rise a few days earlier after the U.S. announced a 90-day pause on reciprocal tariffs. Such trade policy instability may disrupt the operations of chemical companies.

Find a detailed analysis of the liquid crystal polymers market in the in-demand research report “Liquid Crystal Polymers (LCP) 2025 Global Market Review and Forecast to 2034”.