Polycarbonate (PC) belongs to a group of high-performance thermoplastic polymers, made primarily from bisphenol-A (BPA) and phosgene, with bisphenol-A typically produced from intermediate compounds such as phenol and acetone. Polycarbonate is known for its outstanding performance characteristics, including high impact strength, dimensional stability, optical clarity, thermal resistance, ease of processing, low-temperature toughness, and excellent dielectric properties. Its applications are diverse and mainly come from the electrical industry, automotive components, construction materials, optical media, medical devices, consumer goods and appliances, as well as packaging.

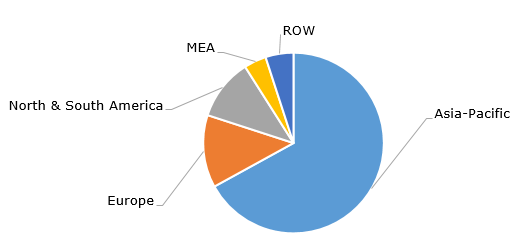

The current global demand for polycarbonate exceeds 5 million tonnes per year, demonstrating an annual growth of about 2-3%, while polycarbonate production capacity is estimated to be in the range of 7.1 and 7.8 million tonnes per year, which eventually leads to polycarbonate oversupply. Often coupled with the lack of demand, this oversupply adversely affects polycarbonate prices and profitability margins. The Asia-Pacific region accounts for the largest share of polycarbonate consumption.

Polycarbonate: structure of the global consumption by region

Consequently, many companies view the polycarbonate market in Asia Pacific, especially in China, as promising. For example, SABIC and SINOPEC have jointly constructed and launched a new PC facility in China with an annual production capacity of 260,000 tonnes.

The market for standard polycarbonate is expected to experience minimal growth, primarily due to subdued demand from the construction and consumer goods sectors. As a result, companies such as Covestro, a global leader in polycarbonate manufacturing, are increasingly focusing on specialty polycarbonates with customizable properties, as well as blends of polycarbonate with other materials (e.g., ABS, SAN, PBT or PET). These specialty polycarbonates are seeing growing demand in sectors such as electromobility and 5G telecommunications.

To support this strategic shift, Covestro has completed a project for a new production facility dedicated to polycarbonate copolymers at its site in Antwerp, Belgium. Similarly, Trinseo, a specialty materials solutions provider and another major polycarbonate producer, also manufactures polycarbonate blends with ABS, PET, or colorants. Trinseo has shown a clear preference for value-added products and has announced the potential closure of its virgin polycarbonate production facility in Stade, Germany. The company cited weak demand, shrinking profit margins, and oversupply from offshore producers as key reasons for this decision. This trend is expected to continue into 2025, particularly in the European and U.S. markets, which remain oversupplied and influenced by tariff policies.

Covestro is committed to becoming fully circular and carbon-neutral by 2050. This sustainability megatrend is pivotal for the polycarbonate sector. SABIC became the first in the industry to produce the so-called circular polycarbonate based on advanced recycling, thus significantly reducing the carbon footprint of its polycarbonate.

Find a detailed analysis of the polycarbonate market in the in-demand research report “Polycarbonate (PC): 2025 World Market Outlook and Forecast up to 2034”.