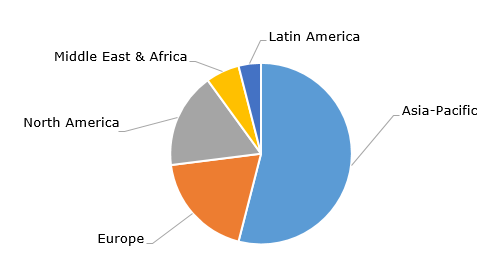

Acrylic acid is an unsaturated carboxylic acid and an important commodity chemical. Being a versatile monomer of functional polymers, acrylic acid is used to make polymeric adhesives, binders, coatings, detergents, dispersants, lacquers, paints, surfactants and other products. As a monomer, acrylic acid is also employed to produce superabsorbent polymers (SAPs), which are cross-linked hydrophilic materials used predominantly in personal hygiene products, such as baby diapers, sanitary napkins, etc. The global annual production of acrylic acid is more than 8 million tonnes and is expected to grow by 4-5% per year in the coming 5 years. Asia-Pacific accounts for the largest share of demand for acrylic acid.

Acrylic acid: structure of the global demand by region

Depending on its end-use, acrylic acid is commercially available in two primary grades: crude (technical) grade and high-purity glacial acrylic acid. Technical grade acrylic acid is predominantly used to produce acrylic esters such as butyl acrylate, ethyl acrylate and methyl acrylate, while high-purity glacial acrylic acid is primarily used to manufacture superabsorbent polymers and polyacrylic acid. Crude acrylic acid can be purified to glacial acrylic acid. In the U.S., glacial acrylic acid production capacity exceeds 900 thousand tonnes per year, while the production capacity of technical acrylic acid is only slightly bigger than 300 thousand tonnes per year.

There are multiple ways to manufacture acrylic acid. Acrylic acid can be produced by sequential dehydration and oxidation of glycerol, which is further converted to acrolein. This is a preferred and economically viable way with a high yield. Ethylene can be used as a feedstock material to make acrylic acid. When oxidized, both propylene and propane can act as raw materials for acrylic acid origination. Two-step oxidation of propylene is a conventional technique to produce acrylic acid. Acrylic acid is primarily derived from petrochemicals, making its price highly dependent on the cost of petrochemical feedstocks. As a result, acrylic acid prices tend to mirror the price dynamics of key inputs such as propylene, leading to frequent and significant fluctuations. Between 2010 and 2020, prices varied by more than 100%.

As an alternative to fossil-based acrylic acid, technologies for the large-scale industrial production of acrylic acid from bio-renewable sources are currently under development. One viable approach involves the dehydration of lactic acid, which itself can be produced through the fermentation of sugars. For example, following pilot-scale production, LG Chem plans to develop an industrial facility to manufacture bio-based acrylic acid using microbial fermentation of plant-derived raw materials.

Sustainability has become a central focus in corporate strategies within the acrylic acid market. Arkema, for example, plans to reduce carbon emissions by 20% and improve energy efficiency by 25% at its innovative acrylic acid purification unit in Carling, France, which is scheduled to begin operations in 2026. The combination of significant environmental benefits with increased production capacity represents a notable achievement for Arkema. Similarly, BASF is developing a bio-based ethyl acrylate production process in Ludwigshafen, using bioethanol as the alcohol source. Interestingly, the cost of producing acrylic acid from renewable resources is now comparable to that of fossil-derived acrylic acid.

Find a detailed analysis of the acrylic acid market in the in-demand research report “Acrylic Acid: 2025 World Market Outlook and Forecast up to 2034”.