The acrylonitrile market is on the cusp of pivotal change. As industries worldwide intensify their focus on performance materials and sustainable manufacturing, the demand for acrylonitrile is rising in tandem. This versatile chemical, essential for producing ABS resins, acrylic fibers, and nitrile rubber, supports key sectors including automotive, electronics, textiles, and construction.

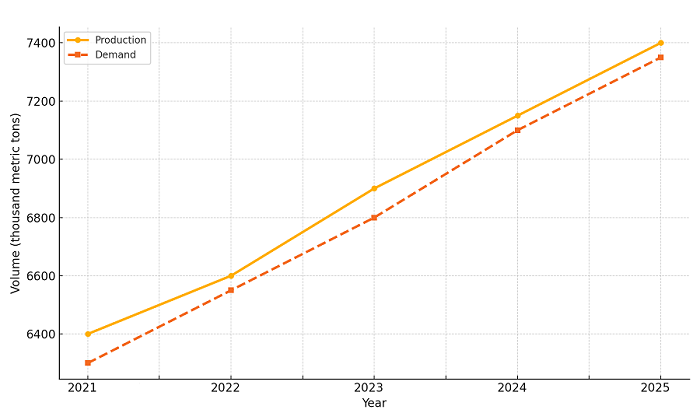

2025 will mark a defining year, shaped by emerging manufacturing hubs, constrained feedstock supplies, and geopolitical shifts. While production capacity is expected to reach approximately 7.4 million metric tons globally, demand is set to trail closely at 7.35 million metric tons, signaling a tightly balanced market.

The Evolving Global Supply Chain

Supply chain dynamics are being reshaped by multiple forces, and acrylonitrile producers are facing intense pressure to adapt. The industry continues to be dominated by producers in Asia, particularly China, South Korea, and Taiwan. However, rising protectionist policies in the United States and Europe are leading to increased tariffs and anti-dumping regulations, prompting producers to reevaluate their logistics and distribution strategies.

The reliance on propylene as a key feedstock has become a bottleneck. With global refiners shifting towards cleaner fuel alternatives and bio-refining, traditional sources of petrochemical byproducts like propylene are diminishing. This is contributing to a sustained increase in propylene prices, with early 2025 figures already showing a 15% rise year-on-year. As a result, many acrylonitrile manufacturers are reconsidering feedstock procurement strategies or exploring alternative production methods.

In addition, shipping challenges remain unresolved. Although global logistics have improved since the height of the COVID-19 pandemic, freight rates remain significantly elevated. In several trade lanes, especially between Asia and North America, rates are still 18–22% higher than pre-2020 levels. Congestion and port delays persist, complicating inventory planning and increasing the cost of doing business.

Acrylonitrile Market: Production vs Demand (2021-2025)

Regional Market Outlooks and Growth Zones

Asia-Pacific remains the center of gravity for the global acrylonitrile market. With China’s continued industrial expansion and India’s rise in automotive and synthetic textile production, demand in the region is accelerating. By 2025, China is projected to account for nearly half of global acrylonitrile output, with India emerging as a fast-growing consumer market.

North America is also experiencing a strategic resurgence. Domestic manufacturers, supported by favorable government policy, are reinvesting in local production capabilities. Major players are upgrading plants with automation, digitization, and emissions-reduction technologies, which are expected to boost capacity and enhance supply chain resilience.

In Europe, sustainability regulations are driving change more than raw demand. Producers are investing in renewable feedstocks and green energy sources to comply with tightening environmental standards. While this has increased operational costs, it has also opened new market segments for bio-based and low-carbon acrylonitrile derivatives.

Technology Driving Competitive Advantage

Technology is becoming a key differentiator in the acrylonitrile market. Companies are racing to improve efficiency and reduce environmental impact, particularly through enhancements to the SOHIO process and better catalyst technologies. Innovations such as fluidized bed reactors and selective ammonia oxidation have significantly reduced waste and increased output yields.

More transformative, however, is the exploration of bio-based acrylonitrile. Although still in its early stages, this approach offers a pathway to significantly lower greenhouse gas emissions. Industry observers expect bio-based alternatives to account for a modest but growing share of total production within the next few years, particularly in regions with strict carbon regulations.

Sectoral Shifts and Emerging Demand Trends

Beyond traditional markets, new demand centers are emerging. The automotive sector, especially in electric vehicles, is driving higher consumption of ABS resins and nitrile components due to their lightweight and heat-resistant properties. In construction, acrylonitrile-derived materials are being used in innovative insulation and piping solutions. Meanwhile, the healthcare industry continues to rely on nitrile gloves, with Asia witnessing a surge in both production and consumption post-pandemic.

This broadening application base is encouraging both vertical and horizontal expansion among leading producers. Some are investing in downstream integration to produce ABS and other derivatives directly, while others are forming strategic partnerships with end-user industries to ensure consistent off-take.

Final Thoughts

For stakeholders in the acrylonitrile market, the path forward in 2025 requires clear priorities. Ensuring feedstock stability, especially amid volatile energy markets, will be vital. Regional diversification, both in terms of sourcing and production, can help mitigate trade risks and supply disruptions. And perhaps most critically, adopting sustainable production practices will not only address regulatory pressures but also appeal to a growing base of environmentally conscious customers. The companies that successfully navigate these complexities, balancing innovation with scalability, and agility with long-term vision, are the ones best positioned to lead in a competitive and evolving global market.

Find a detailed analysis of the acrylonitrile market in the in-demand research study “Acrylonitrile (ACN): 2025 World Market Outlook and Forecast up to 2034”.