The global monoethylene glycol (MEG) market is witnessing a notable expansion, largely driven by the surging demand for polyethylene terephthalate (PET) packaging. MEG, a critical raw material in polyester production, has become central to industries ranging from food and beverage packaging to textiles. Rising consumer reliance on packaged goods, coupled with sustainability-focused innovations in PET recycling, is fueling unprecedented growth in MEG consumption.

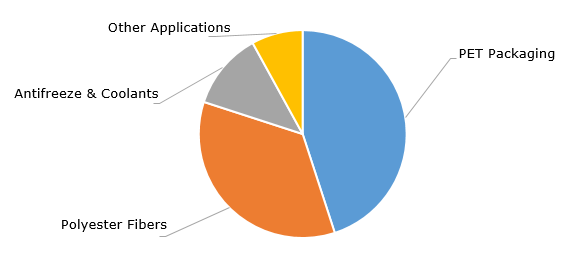

Structure of the MEG Demand, by Application, 2024

Rising Importance of PET Packaging in Global Markets

PET packaging has emerged as a cornerstone of modern consumer lifestyles. From bottled water and carbonated beverages to ready-to-eat meals, PET containers offer durability, cost-efficiency, and recyclability. According to industry data published in 2024, PET accounts for nearly 70% of all beverage packaging worldwide. Since MEG constitutes around 30% of PET resin by weight, the correlation between PET expansion and MEG demand is direct and powerful.

Monoethylene Glycol Market Size and Growth Outlook

The global MEG market was evaluated at about USD 28.7 billion in 2023 and is slated to expand at a 5.2% CAGR through 2030, reaching nearly USD 41.5 billion by the end of the forecast period. APAC remains the dominant hub, accounting for more than 60% of consumption, driven by China’s large polyester and PET industries. North America and Europe follow, boosted by rising packaging needs in the food, pharmaceuticals, and e-commerce sectors.

Sustainability and Recycling Driving New Opportunities

Governments and corporations are increasingly focused on closed-loop recycling systems. Advanced technologies in chemical recycling allow PET waste to be broken down into MEG and purified terephthalic acid (PTA), which can then be repolymerized into virgin-quality PET. This innovation is not only reducing environmental impact but also creating a secondary demand cycle for MEG.

For instance, the European Union’s Circular Economy Action Plan mandates higher recycling rates, pushing beverage and food brands toward PET as a sustainable packaging solution. As a result, MEG suppliers are investing in bio-based production routes to align with stricter environmental standards.

Key Industry Players and Strategic Moves

Major MEG producers are actively expanding capacities and partnering with PET manufacturers to meet growing global demand. Companies such as SABIC, Reliance Industries, Lotte Chemical, and Dow Inc. are investing in both traditional petrochemical-based MEG production and bio-based alternatives. Strategic acquisitions and joint ventures are strengthening their foothold in high-demand regions.

Future Outlook: Packaging to Remain the Growth Engine

The MEG market’s future is intricately tied to the global PET packaging boom. With the food & beverage industry expanding rapidly, especially in emerging economies, demand for MEG will remain robust. Moreover, regulatory pushes for recyclability, combined with consumer preference for lightweight, durable packaging, will ensure PET continues to dominate, thereby cementing MEG’s role as a critical raw material.

The monoethylene glycol market is exhibiting strong growth momentum, largely propelled by PET packaging demand. As industries evolve toward sustainable, recyclable, and efficient packaging, MEG’s relevance in the value chain will only intensify. Companies that innovate in bio-based MEG production and invest in circular PET recycling technologies will be best positioned to capitalize on this expanding market.

Find a detailed analysis of the MEG market in the in-demand research report “Monoethylene Glycol (MEG): 2025 World Market Outlook and Forecast up to 2034”.