Fatty alcohol 2-ethylhexanol (2-EH) is a large-tonnage organic chemical used in numerous applications such as solvents, flavors, functional fluids, emollients, coating agents and fragrances. As such, it is embedded into complex chemical product chains (e.g. propylene, synthesis gas, n-butyraldehyde, 2-EH and ethylhexylnitrate), where it acts as a precursor in the production of other chemicals or in various chemical processes, including diesel oil cetane improvement and plastic polymer plasticizing, to name only a few.

The use of 2-EH as a chemical intermediate, especially in the production of plasticizers (which is its major application and which is currently on the rise), increases the number of 2-EH market-affecting factors, thus leading to a more complex, dynamic and fragmented picture of this market.

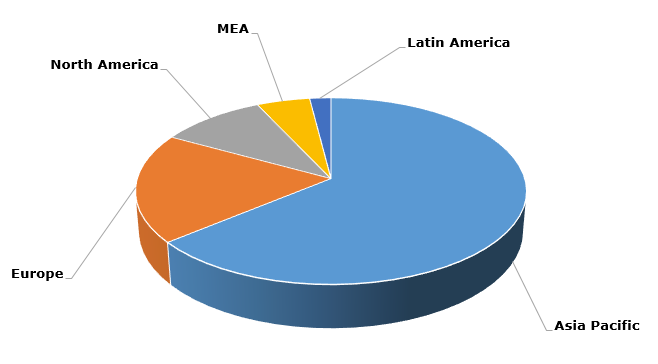

With significant dominance of Asia Pacific (and specifically China) in 2-EH production and consumption, this market remains highly Asia-oriented.

2-ethylhexanol: structure of the global production capacity, by region (2016)

This is despite large 2-EH capacities in North America (e.g. Eastman Chemical’s facility in Longview, TX or a new BASF’s plant in Pasadena, TX, which are now affected by farce majeure circumstances following Hurricane Harvey) and Europe (e.g. Oxea Group’s plant in Oberhausen, Germany). However, these capacities and additions could not match Asian 2-EH production potential, which has been steadily growing (e.g. Luxi Chemical’s new 300,000 tonne/year n-butanol (NBA)/2-EH facility in addition to 300,000 tonne/year facility in Liaocheng).

More information on the 2-ethylhexanol (2-EH) market is available in the in-demand research report “2-Ethylhexanol (2-EH): 2017 World Market Outlook and Forecast up to 2021”.