The global and regional markets for butadiene, which is as an important intermediate embedded in various commodity chains (primarily leading to the production of synthetic rubbers, such as styrene butadiene rubber), have been demonstrating significant share of volatility.

The current downfall in butadiene prices worldwide is a vivid example of such market volatility. Among various reasons of the downfall, multiple experts single out the reductions in feedstock and end-product prices (promoted by weak market sentiment at butadiene downstream markets), seasonal factors and the impact rendered by the natural rubber sector.

However, the above-mentioned volatility can easily reverse this dynamic should other factors intervene. Just a short time ago, butadiene prices in the USA, for instance, were on the rise.

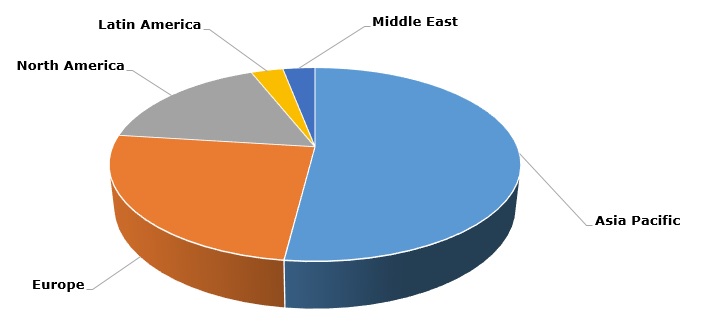

Butadiene: structure of the global capacity broken down by region, 2016

Among other factors, the rise was influenced by a major logistics disruption and force majeure circumstances caused by hurricanes striking the Mexican Gulf coastal regions. This affected butadiene-producing facilities too. The impacted zones included Houston and Port Neches (where TPC Group operates butadiene facilities with capacity of 545,000 and 408,000 tonnes per year, respectively), Channelview (a 500,000 tonne/year butadiene plant owned by LyondellBasell), as well as Baton Rouge and Baytown (ExxonMobil’s butadiene plants with capacity of 175,000 and 150,000 tonnes per year). Though the US is only a third largest butadiene-producing market, its influence on the global butadiene market situation must not be underestimated.

More information on the butadiene market can be found in the in-demand research report “Butadiene (BD): 2017 World Market Outlook and Forecast up to 2027”.