Ethanol (ethyl alcohol) is an important chemical compound that is used in a wide range of applications, such as the production of transport fuel blends, sanitizers, disinfectants, cosmetic products, paints, pharmaceuticals, beverages, preservatives for biological specimens, to name only a few. Overall, the ongoing Covid-19 pandemic has rendered a significant impact on these application areas: the pandemic has unbalanced different markets, disrupted distribution channels, and altered existing consumption patterns. The appearance of new Covid variants, like Delta and Omicron, means that the influence of the pandemic is far from over as new lockdowns are planned and some restrictions are now once again in place in various regions of the world. The pandemic created significant demand for sanitizers, which was met to a larger degree throughout 2021 when tangible inventories of sanitizers were originated. Therefore, the current demand for sanitizer-grade ethanol is satisfied, which helped to balance the ethanol market at least in this ethanol application area.

For the ethanol market, which started to look more balanced in Q3 and Q4 2021, this new wave of the pandemic, associated with the Omicron variant, may pose certain risks. This disturbance coincided with skyrocketing gas prices and the unprecedented rise in grain stockpiling (especially by China, which accumulated huge staple food reserves), paralleled by rather modest harvests (incl. corn, sugarcane, and sugar beet) in the US and Europe, which boosted grain and food prices worldwide. This led to the drop in the inventories of commercial-scale cellulosic ethanol, which is always under multiple pressures from crop price fluctuations, agricultural yields, weather conditions, and conventional fuel market behavior. For instance, Valero, which operates 12 ethanol plants in the US and Canada, reported lower output and operating losses in its ethanol division within 2021.

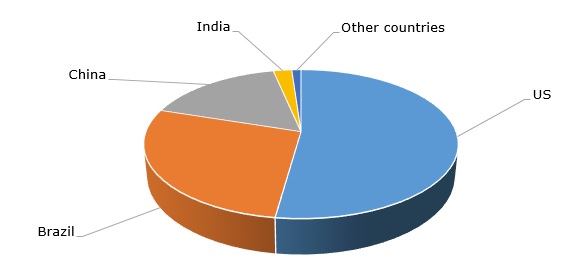

Against this background, the decision of Brazil’s energy company Raízen SA to build its second cellulosic ethanol plant in Brazil seems highly relevant (the USA and Brazil are the world’s largest ethanol producers.

Ethanol: structure of the global production by country

Unsurprisingly, the future output of the new plant has already been reserved by an unnamed company via a long-term contract with Raízen. In a similar vein, POET, the world’s largest producer of biofuels, has acquired the entire bioethanol assets of Flint Hills Resources. Likewise, India plans to boost its ethanol production to over 4 bn liters by 2025 in order to achieve the national target of fuel blends to have a 20% ethanol content. These facts confirm that the global ethanol market is currently in search of a new equilibrium when faced with unprecedented challenges like pandemics, environmental crises, or food security issues.

Find more information on the global ethanol market in the in-demand research report “Ethanol (EtOH): 2021 World Market Outlook and Forecast up to 2030”.