Ethylene is an important chemical building block, which is indispensable in the production of multiple downstream products. Among such products, one can list polyethylene (incl. low-density polyethylene and linear low-density polyethylene), ethylene oxide (an intermediate for ethylene glycols and polyethylene terephthalate), ethylene dichloride (an intermediate for vinyl chloride monomer) and ethylbenzene (derived by reacting ethylene with benzene to convert to styrene). These chemicals shape the modern chemical industry and act as a cornerstone for a myriad of end-product markets, like transportation, construction, packaging, electrical and electronic goods, and medical devices, to name only a few.

It is known that the global ethylene market mirrors macroeconomic conditions. Current macroeconomic conditions are primarily characterised by rising costs of ethylene upstream products, i.e. naphtha (a key feedstock for ethylene production mostly in Europe and Asia), ethane (a key feedstock for ethylene production mostly in the U.S.), and propane. Apart from that, the ethylene market is now driven by such factors as the logistics crisis, disrupted supply chains, high inflation, and growing political instability in Eastern Europe. New COVID waves occurring in different parts of the world, including Asia and Europe, raise fears of unplanned ethylene cracker outages, which may significantly aggravate ethylene availability against the background of a rather high demand for plastics worldwide. These challenges can destabilise the global ethylene market, which needs some time to adapt to the current shock, especially with respect to skyrocketed crude oil prices, suffering global trade, and curtailed supply from Russia.

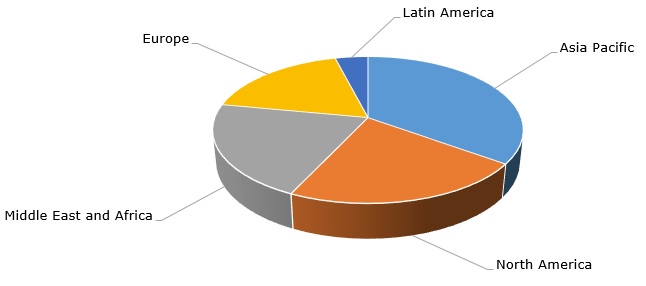

European ethylene crackers are in the most vulnerable position and have to reduce capacity utilization rates. Europe accounts for about 18% of the world’s ethylene production capacity, while the biggest additions to global ethylene production capacity are planned in Asia, especially in China (current global ethylene production capacity exceeds 200 mln mty).

Ethylene: structure of the global production capacity by region

Ethylene prices show an upward trend in Europe and Asia, which is likely to remain in the nearest future, though other factors may intervene to dampen the price rise. As of mid-March 2022, ethylene prices in Europe exceeded EUR1460/mt (free delivered, northwest Europe), while Asian ethylene prices raised slightly to around USD1300/mt (cost and freight, Northeast Asia). At the same time, US ethylene prices showed a downward trend due to cheaper ethane-based feedstock and ample ethylene supply. US spot ethylene prices fluctuated within the range of USD630/mt and USD 650/mt, effective mid-March 2022.

Amid the global rise in volatility, the ethylene market has been undergoing transformation to become greener and more ecologically friendly. For instance, Dow, the world’s largest ethylene producer, plans to upgrade its 1.4 mln mty ethylene plant in Fort Saskatchewan (Canada) to decrease the plant’s current carbon footprint. Dow decided to reduce annual carbon emissions at this plant by 30% by 2030, making a step towards carbon neutrality of its manufacturing operations and operating the world’s first net-zero carbon emissions ethylene plant. If realised, this would be a major achievement for the company and for the ethylene industry in general.

More information on the global ethylene market can be found in the insightful research report “Ethylene (ET): 2022 World Market Outlook and Forecast up to 2031”.