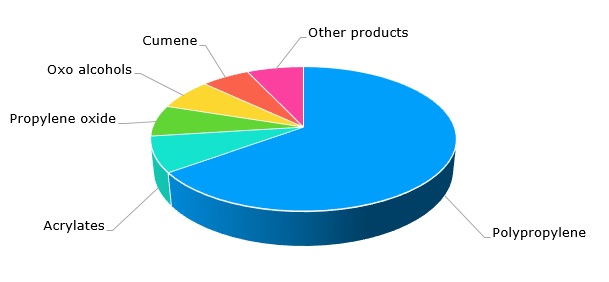

Propylene is an indispensable basic chemical that helps to lay a robust groundwork for the global petrochemical industry. It is used as a feedstock to manufacture a broad range of vital chemical products applied in a myriad of consumption sectors. These products include polypropylene (polypropylene accounts for the bulk of propylene consumption), acrylates, propylene oxide, oxo alcohols, cumene, glycols, and butyraldehyde.

Propylene: structure of the global consumption by product

Propylene is manufactured by different industrial routes. Propylene is mainly derived via ethylene co-production, which therefore solidifies a strong co-dependence between the propylene and ethylene markets. Alternative propylene manufacturing pathways involve naphtha steam cracking; dehydrogenation of propane and metathesis of ethylene and butylenes; the use of coal-to-oil processes and other methods. These production methods closely link propylene output with petroleum refinery economics.

This tight embeddedness of propylene production in petrochemical value chains creates a strong bond between integrated oil and gas companies, on the one hand, and key petrochemical producers, on the other hand. To illustrate this point, one can mention the close cooperation between Borealis and OMV, which makes the latter a leading manufacturer of ethylene and propylene in Europe and a major polymer producer in the world (OMV now owns a 75% stake in Borealis). OMV has been supplying Borealis with propylene via pipelines. Both companies are cooperating to develop low-carbon future scenarios and circular economy solutions. This sustainability-oriented activity forms the most vital trend in the global petrochemical sector. Likewise, ExxonMobil’s new plastic recycling plant (the plant also recycles polypropylene) is now fully embedded into the company’s petrochemical operations, including propylene production.

In general, 2022 was a turbulent year for the whole petrochemical industry, generating many instabilities and uncertainties, driven by energy and feedstock price hikes, COVID zero tolerance policies in China, weaker consumer sentiment, logistics disruptions, and political unrest worldwide. In H2 2022, various petrochemical producers, especially in Europe, have to idle their production facilities due to exorbitant energy and feedstock costs. Companies were raising prices too. For example, BASF had to significantly increase prices along the propylene value chain in H2 2022. However, later in the year, the drop in the demand within this chain provided downward pressure on propylene prices, especially in Europe.

These instabilities of the global petrochemical industry were in complex feedback and autocatalytic relationships with other consuming sectors. Nevertheless, despite these challenges, key petrochemical producers, including propylene ones, were demonstrating quite strong performance across various petrochemical segments. The same applies to the propylene market prospects, which confirms the great potential of propylene value networks. Unsurprisingly, companies have been realizing various petrochemical capacity expansion projects worldwide even in a very difficult macroeconomic climate when companies like BASF had to significantly reduce their production costs. For instance, BASF will launch a large multi-stage petrochemical complex in Zhanjiang, Guangdong, China. The complex will manufacture a vast range of petrochemical products, including propylene and its derivatives. LyondellBasell will follow the suit with the expansion plans for its propylene production facility in Channelview Complex near Houston.

A detailed analysis of the global propylene market can be found in the insightful research report “Propylene: 2022 World Market Outlook and Forecast up to 2031”.