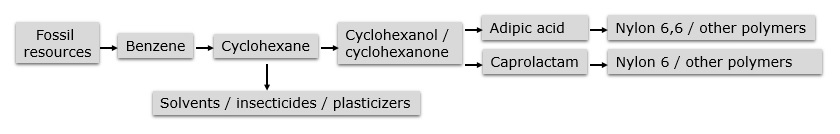

Cyclohexane (CX) is an intermediate chemical product used to manufacture cyclohexanol, cyclohexanone, adipic acid, and caprolactam. The latter serves as a precursor for making nylon 6 fibres and polyamide engineering plastics, which are in turn applied in a range of commodities and industries, such as car making, electronics, packaging, wire, and cabling, to name only a few. Over 60% of cyclohexane demand comes from caprolactam in nylon 6 manufacturing. Apart from its role as an intermediate, cyclohexane can directly be employed to produce solvents, insecticides, and plasticizers. Global cyclohexane production exceeds 6 million mty.

Simplified visualization of cyclohexane-involving value chains

Industrial cyclohexane mainly originates via a technological process that involves benzene hydrogenation. Therefore, the cyclohexane market is significantly impacted by both benzene market fluctuations and by demand for cyclohexane derivatives and end products along the whole value chain. Currently, the global benzene market looks stabilized with benzene contract prices settled at around USD850-950 per mt with little variation between regional markets. This contrasts with July 2022 when benzene prices reached their peak driven by the high costs of hydrocarbon resources and energy. This is typical of the cyclohexane market with its cyclical nature of ups and downs rather than a steady year-on-year growth pattern. In parallel with that trend, in early H2 2023, demand for end products on cyclohexane-consuming markets remains weakened against the background of the stagnating business environment, inventory destocking, and the worldwide economic slowdown. In H1 2023, the combination of these two trends shaped the cyclohexane market.

Another strong trend focuses on the incorporation of the principles of sustainable development and polymer circularity in cyclohexane production. For instance, CEPSA, a Spanish multinational energy company, greatly relies on the use of green hydrogen at its La Rábida refinery. CEPSA operates 180,000 mty cyclohexane production capacity at this refinery. Other key cyclohexane manufacturers, such as BASF, bp, Chevron Phillips Chemical, and ExxonMobil, act in a similar way by trying to reduce carbon footprint, energy consumption, and waste.

Find a detailed analysis of the cyclohexane market in the in-demand research study “Cyclohexane (CX): 2023 World Market Outlook and Forecast up to 2032”.