Cyclohexane (CX) belongs to a group of monocyclic saturated hydrocarbons, known as common cycloalkanes or naphthenes. Cyclohexane acts as a key chemical intermediate derived from benzene. In industrial processes, the liquid-phase oxidation of cyclohexane yields cyclohexanone and cyclohexanol, which can subsequently be converted into adipic acid and caprolactam. These compounds serve as essential feedstock chemicals for nylons (polyamides or PA). Adipic acid is polymerized with hexamethylene diamine to produce nylon-6.6 (PA 6.6), while the polymerization of caprolactam results in nylon-6 (PA 6). The final products in this extensive value chain include various plastics, synthetic fibres, textiles, automotive components, packaging materials, paints, coatings, adhesives, solvents, lubricants, plasticizers, and fuel additives.

Cyclohexane can be produced sustainably. For example, the energy company BP utilizes bio-based and bio-circular feedstocks, such as rapeseed oil and biomass, for the production of “green” cyclohexane. Collaboration between companies to supply sustainable materials is becoming increasingly common. Similarly, Cepsa, a major cyclohexane manufacturer (renamed Moeve in October 2024), has been supplying Unilever with renewable and biodegradable linear alkylbenzene. The rebranding and name change to Moeve align with the company’s strategy to become a leader in sustainable energy and mobility, reflecting its commitment to shifting its business operations toward sustainable practices.

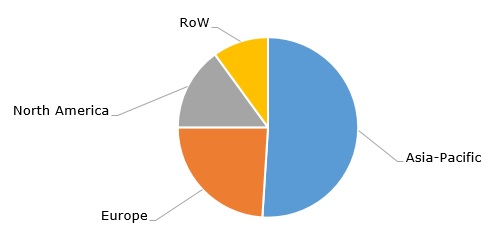

The conversion of cyclohexane into derivatives such as caprolactam enhances the value of the original hydrocarbons. For example, in early January 2025, the price of cyclohexane was USD 960 per tonne (FOB East China), whereas caprolactam in the same region and under identical terms was priced at USD 1,500 per tonne. The Asia-Pacific region represents the largest consumer of cyclohexane globally.

Сyclohexane: structure of the global consumption by region

Global cyclohexane production is approximately 7.5 million tonnes per year. However, cyclohexane production in some countries has experienced notable fluctuations. For example, U.S. cyclohexane production dropped from nearly 1.4 million tonnes in 2000 to around 1 million tonnes during the 2007-2008 financial crisis, later recovering to 1.22 million tonnes in 2015, only to fall below 0.9 million tonnes during the COVID years. Likewise, cyclohexane production in Japan plummeted from 379 thousand metric tonnes in 2013 to about 90 thousand metric tonnes in 2023, with some ups and downs over a decade.

The turbulent nature of cyclohexane market dynamics is driven by the market’s strong reliance on various macroeconomic factors (a trait typical of the entire petroleum products market) and significant demand fluctuations in key downstream sectors, particularly nylon, paints, and coatings. To illustrate, the European cyclohexane market in late 2024 demonstrated bearish behaviour due to weak demand from major downstream sectors, a lack of optimism, and challenging macroeconomic conditions. Looking ahead, the European cyclohexane market in the first half of 2025 is expected to show similar trends, dominated by lukewarm demand and subdued sentiment.

Notably, in 2023, the Netherlands emerged as the world’s leading exporter of cyclohexane, exporting over 126 thousand metric tonnes valued at approximately USD 159 million. Meanwhile, Belgium stood out as the world’s leading importer of cyclohexane, with an import volume of nearly 400 thousand metric tonnes valued at USD 445 million. However, the high export figures for the Netherlands are likely to reflect the production capabilities of major cyclohexane manufacturers, such as ExxonMobil’s Rotterdam Aromatics Plant. Likewise, significant import volumes of Belgium reflect its operation as a prominent transit and trading hub. One can recall a strategic partnership between BP and LANXESS according to which BP supplies sustainably produced cyclohexane to the LANXESS production site in Antwerp, Belgium, starting from Q4 2021.

Find a detailed analysis of the cyclohexane market in the in-demand research report “Cyclohexane (CX): 2025 World Market Outlook and Forecast up to 2034”.